-

Posted On Monday, October 28, 2019 by Evan Lamolinara

Research by SalesLeads’ experienced industrial market research team, shows 76 new planned Food and Beverage industry projects tracked during the month of October.

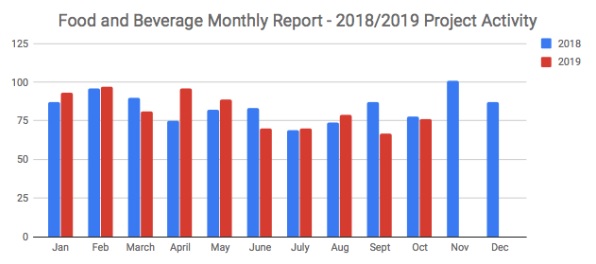

Planned industrial project activity within the sector increased by 12% from the previous month, but is down 1% YTD from the previous year.

The following are selected highlights on new Food and Beverage industry construction news.

Food and Beverage Project Type

Processing Facilities - 61 New Projects

Distribution and Industrial Warehouse - 25 New Projects

Food and Beverage Project Scope/Activity

New Construction - 28 New Projects

Expansion - 19 New Projects

Renovations/Equipment Upgrades - 36 New Projects

Plant Closing - 4 New Projects

Food and Beverage Project Location(Top 10 States)

California - 9

Ohio - 5

Texas - 5New York - 4

Michigan - 4

Kentucky - 3

Florida - 3

Ontario - 3

Massachusetts - 3

Georgia - 2

Largest Planned Project

During the month of October, our research team identified 6 new Food and Beverage facility construction project with an estimated value of $100 million or more.

The largest project is owned by Cargill, Inc., who is planning to invest $225 million for an expansion of their soybean processing facility in SIDNEY, OH. Completion is slated for 2022.

Top 10 Tracked Food and Beverage Projects

ARIZONA:

Nutritional supplements mfr. is planning to invest $150 million for the renovation and equipment upgrades a recently acquired 397,000 sf warehouse and processing facility in PHOENIX, AZ.

INDIANA:

Foodservice distributor is planning to invest $150 million for the construction of a 500,000 sf distribution center in WESTFIELD, IN. They are currently seeking approval for the project. Construction is expected to start in Spring 2020, with completion slated for late 2021.

ONTARIO:

Petcare products mfr. is planning to invest $120 million for the construction of a 900,000 sf distribution center on Coleraine Dr. in CALEDON, ON. They are currently seeking approval for the project.

QUEBEC:

Bakery company is planning to invest $170 million for an expansion and equipment upgrades on their processing facility in BOUCHERVILLE, QC. They have recently received approval for the project.

TEXAS:

Bakery company is planning to invest $129 million for the construction of an office and processing facility at 6245 State Hwy. 151 in SAN ANTONIO, TX. They have recently received approval for the project.

GEORGIA:

Seafood and meat company is expanding and planning to invest $27 million for the construction of a 47,000 sf warehouse and processing facility adjacent to their plant in ATLANTA, GA. They are currently seeking approval for the project.

IDAHO:

Specialty food products mfr. is planning to invest $50 million for the construction of a 300,000 sf processing facility in TWIN FALLS, ID. They are currently seeking approval for the project.

NEW JERSEY:

Bakery company is planning to invest $30 million for the renovation and equipment upgrades on their manufacturing facility in VINELAND, NJ.

CALIFORNIA:

Almond processing company is planning to invest $25 million for a 255,000 sf expansion, renovation, and equipment upgrades on their warehouse and processing facility at 6914 Rd. 160 in EARLIMART, CA. They have recently received approval for the project.

MANITOBA:

Grain processing company is planning to invest $94 million for the construction of a processing facility in ROSSER, MB. They have recently received approval for the project.

Since 1959, SalesLeads, based out of Jacksonville, FL has been providing Industrial Project Reports on companies that are planning significant capital investments in their industrial facilities throughout North America. Our professional research team identifies new construction, expansion, relocation, major renovation, equipment upgrades, and plant closing project opportunities so that our clients can focus sales and marketing resources on the target accounts that have an impending need for their products, services, and indirect materials.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

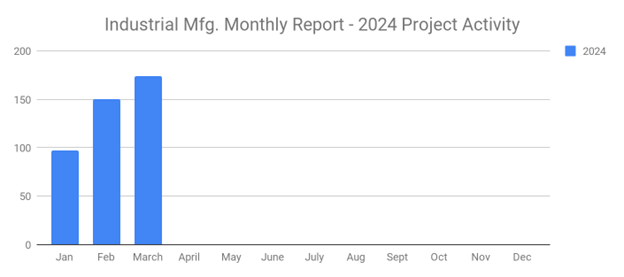

Q1 2024 Ends on a Strong Note with March Producing 174 New Industrial Manufacturing Planned Projects

-

Q1 2024 Ends on a Strong Note with March Producing 174 New Industrial Manufacturing Planned Projects

-

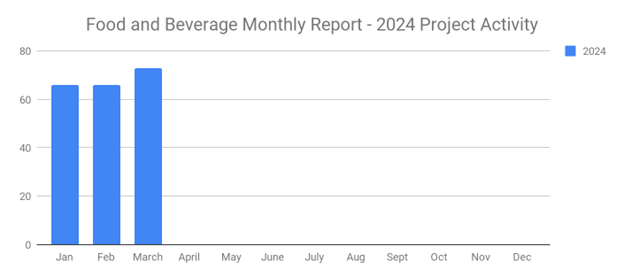

Q1 Brings Strength to the Food and Beverage Industry with 73 New Planned Industrial Project for March 2024

-

Q1 Rebounds with 202 New Distribution and Supply Chain Planned Industrial Projects in March 2024