How much money do your B2B company's accounts typically spend in a given period? Some accounts will obviously spend more than others. Key accounts, for instance, are high-value accounts with deep pockets, so they naturally spend more than other accounts. Rather than blindly guessing account expenditures, however, you should consider tracking your B2B company's Average Revenue Per Account (ARPA).

What Is ARPA?

Also known as Average Revenue Per Customer (ARPC), ARPA is a performance metric that reveals the average amount of revenue each of your B2B company's accounts bring during a specified period, such as a fiscal quarter or a year. It's calculated by taking your B2B company's total revenue generated during a period and dividing that number by the total number of active accounts your B2B company had during that same period.

If your B2B company generated $100,000 last month across 20 accounts, its ARPA for that month would be $5,000. Of course, you can apply this metric to any period; it doesn't have to be a month. You can calculate your B2B company's ARPA for a month, quarter, year or any other period.

The Importance of Tracking ARPA

Tracking your B2B company's ARPA is important because it provides insight into whether your B2B company is growing or contracting. If it increases, you'll know that your B2B company is growing. If its ARPA is decreasing, on the other hand, it's a sign that your B2B company is contracting. With an ever-increasing ARPA, your B2B company will generate more revenue per each account -- on average, at least -- so it's safe to assume your B2B company is growing. If its ARPA trends downwards in the opposite direction, your B2B company is experiencing a phase of contraction as its accounts are spending less money.

You can also use your B2B company's ARPA to win the confidence of investors. Assuming your B2B company has a high ARPA, investors will probably be more eager to provide financing. Whether you're seeking equity or debt financing, a high ARPA indicates your B2B company is growing and, therefore, profitable. As a result, more investors will offer it financing. For these reasons, it's important to track your B2B company's ARPA.

In Conclusion

ARPA is a performance metric used to calculate the average expenditure of your B2B company's accounts during a given period. It provides insight into whether your B2B company is growing or contracting.

To help you on the trajectory for growth, open an account with SalesLeads. Review some Project Reports to help you grow your pipeline, which in turns grows the company.

What to learn more? Get in Touch

Latest Posts

-

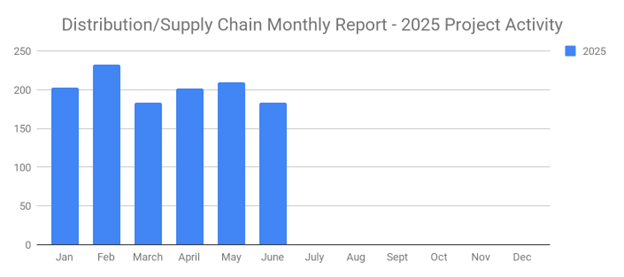

June's New Distribution and Supply Chain Planned Projects Return to March’s 183 Confirmed Figure

-

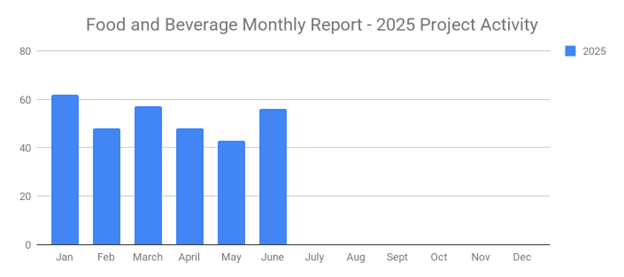

Food and Beverage Rebounds with 56 New Planned Projects Igniting Growth After Decline

-

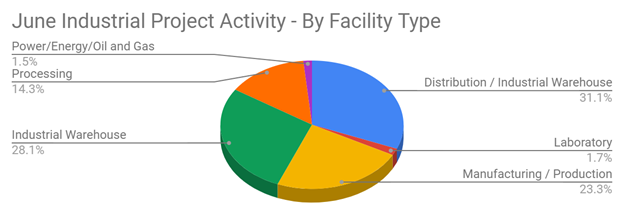

June 2025’s New Industrial Construction Projects Grew 7% Month-Over-Month

-

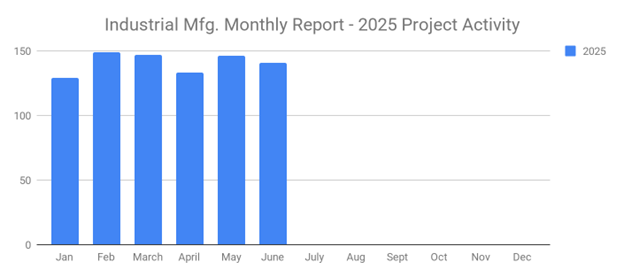

Q2 Industrial Manufacturing Soars 31% for Planned Projects Over $100M; June Planned Industrial Projects Hit 141