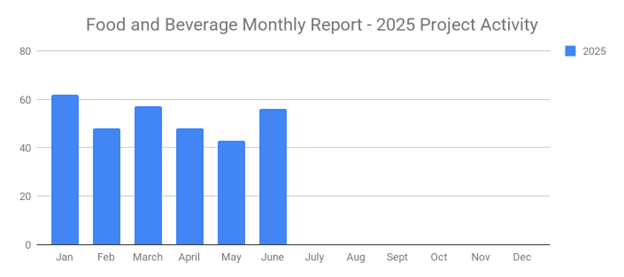

Industrial SalesLeads just released its June 2025 report, revealing a notable rebound in planned capital project spending for the North American Food and Beverage industry. After two months of decline, the sector saw a strong comeback with 56 new projects confirmed. June saw month-over-month growth across all categories with new construction up by 27%, expansion projects increasing by 66%, and renovations / equipment upgrades climbing by 40%. The Firm actively tracks all major industrial capital activity, including new plant builds and significant modernizations.

The following are selected highlights on new Food and Beverage industry construction news.

Food and Beverage Project Type

Processing Facilities - 44 New Projects

Distribution and Industrial Warehouse - 15 New Projects

Food and Beverage Project Scope/Activity

New Construction - 23 New Projects

Expansion - 15 New Projects

Renovations/Equipment Upgrades - 21 New Projects

Plant Closing - 5 New Projects

Food and Beverage Project Location (Top 10 States)

Washington - 7

New York - 6

California - 5

Indiana - 4

Iowa - 3

Maine - 3

Minnesota - 3

Ohio - 3

Tennessee - 3

Virginia - 3

Largest Planned Project

During the month of June, our research team identified 2 new Food and Beverage facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Tuls Dairies, who is investing $186 million for the construction of a 240,000 sf processing facility in SEWARD, NE. Completion is slated for 2027.

Top 10 Tracked Food and Beverage Projects

IOWA:

Meat processing company is planning to invest $135 million for the construction of a processing facility in PERRY, IA. They are currently seeking approval for the project. Completion is slated for late 2026.

NEW YORK:

Foodservice distributor is planning to invest $41 million for the construction of a warehouse and processing facility at 3196 Route 426 in MINA, NY. They are currently seeking approval for the project. Construction is expected to start in Fall 2025. They will relocate operations upon completion in early 2027.

TENNESSEE:

Agricultural co-operative is planning to invest $33 million for the construction of 3 warehouse and office facilities totaling 488,000 sf on Waldron Rd. in LA VERGNE, TN. They are currently seeking approval for the project.

WISCONSIN:

Cheese mfr. is planning for the construction of a 384,000 sf processing facility on State Hwy 57 in PLYMOUTH, WI. Construction is expected to start in Spring 2026. They will relocate their operations upon completion in 2027.

NEW HAMPSHIRE:

Beverage company is planning for the renovation and equipment upgrades on a recently acquired 337,000 sf processing facility at 80 Northwest Blvd. in NASHUA, NH. They are currently seeking approval for the project.

TENNESSEE:

Specialty food product mfr. is planning to invest $30 million for the renovation and equipment upgrades on a recently acquired processing facility in DYERSBURG, TN. They are currently seeking approval for the project. Completion is slated for early 2026.

NEW YORK:

Dairy company is planning to invest $26 million for a 7,700 sf expansion and equipment upgrades on their processing and warehouse facility in BATAVIA, NY. They are currently seeking approval for the project.

INDIANA:

Nutritional supplement mfr. is planning for the construction of a 258,000 sf processing facility at 429 Fintail Dr. in INDIANAPOLIS, IN. They are currently seeking approval for the project.

CALIFORNIA:

Beverage mfr. is planning to invest $11 million for the expansion and equipment upgrades on their production facility in JURUPA VALLEY, CA. They have recently received approval for the project.

OHIO:

Brewery is planning for the renovation and equipment upgrades on a 200,000 sf production facility at 26025 First St. in WESTLAKE, OH. They are currently seeking approval for the project and will relocate their operations upon completion.

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team. Visit us at salesleadsinc.com.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Misc. Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

How Strategic B2B Marketing Supports Industrial Sales Success

-

Moving Beyond Volume: 3 Big Strategies for Developing Industrial Leads

-

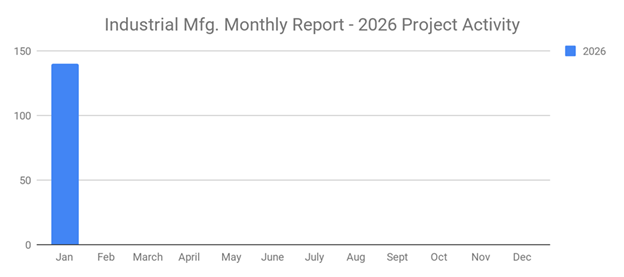

January 2026 Surges with a 22% Increase in New Industrial Projects Erasing December’s Decline of 20%

-

Planned Industrial Construction Projects Start January 2026 Strong with an Increase of 3% from the Previous Month