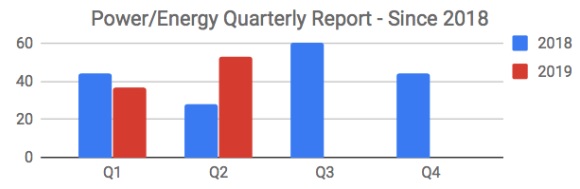

Research by SalesLeads’ experienced industrial market research team, shows 53 new planned Power Generation and Energy industry projects tracked during the 2nd quarter of 2019.

Planned industrial project activity within the sector increased by 30% from the previous quarter, and is up 20% YTD from the previous year.

The following are selected highlights on Power Generation and Energy Industry Construction construction news.

Power Generation and Energy - By Project Scope/Activity

- New Construction - 32 New Projects

- Expansion - 0 New Projects

- Renovations/Equipment Upgrades - 5 New Projects

- Plant Closing - 2 New Projects

Power Generation and Energy - By Project Location(Top 5 States)

- Virginia - 4

- Ohio - 4

- Illinois - 4

- Texas - 4

- Florida - 5

Largest Planned Project

During the 2nd quarter of 2019, our research team identified 15 new Power Generation and Energy construction projects with an estimated value of $100 million or more.

The largest project is owned by Kinder Morgan, Inc., who is planning to invest $8 billion for the construction of an LNG export facility in Pascagoula, MS. They are currently seeking approval for the project. Completion is slated for late 2021.

Top 10 Tracked Power Generation and Energy Construction Projects

Michigan:

Utility service provider is planning to invest $478 million for the renovation and equipment upgrades on their power plant in BRIDGMAN, MI. They are currently seeking approval for the project.

New York:

Energy company is planning to invest $650 million to convert two existing coal-fired power generation plants to renewable energy powered data centers in LANSING, NY. They are currently seeking approval for the project.

Ohio:

Energy company is investing $1 billion for the construction of an 1100MW natural gas-fired power plant in WELLSVILLE, OH. Construction has recently started, with completion slated for June 2021.

Virginia:

Energy company is considering investing $2 billion for the construction of a hydroelectric pump storage facility in TAZEWELL, VA.

Washington:

Hydropower energy company is planning to invest $2 billion for the construction of a hydropower plant in GOLDENDALE, WA. They are currently seeking approval for the project. Construction is expected to start in 2022, with completion slated for 2028.

West Virginia:

Petrochemical company is planning to invest $3 billion for the construction of an ethane storage facility in CHARLESTON, WV. They are currently seeking approval for the project.

Texas:

Energy company is planning to invest $120 million for the construction of a solar plant in BLOOMING GROVE, TX. They have recently received approval for the project.

Ohio:

Hydrocarbon storage facility developer is planning to invest $150 million for the construction of an ethane storage facility in CLARINGTON, OH. They are currently seeking approval for the project. Construction is expected to start in Summer 2019.

Missouri:

Renewable energy company is planning to invest $145 million for the construction of five bio-gas plants across AUDRAIN COUNTY, CHARITON COUNTY, and MILLER COUNTY, MO. Construction is expected to start in Fall 2019, with completion slated for late 2020.

Florida:

Energy company is planning to invest $150 million for the construction of a 150MW solar plant on a 1,000-acre site in CITRUS COUNTY, FL. They are currently seeking approval for the project. Construction is expected to start in late 2019, with completion slated for late 2020.

Since 1959, SalesLeads, based out of Jacksonville, FL has been providing Industrial Project Reports on companies that are planning significant capital investments in their industrial facilities throughout North America. Our professional research team identifies new construction, expansion, relocation, major renovation, equipment upgrades, and plant closing project opportunities so that our clients can focus sales and marketing resources on the target accounts that have an impending need for their products, services, and indirect materials.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Misc. Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch