-

Posted On Friday, February 05, 2021 by Evan Lamolinara

SalesLeads announced today the CY2020 results for the new planned industrial capital project spending report for the state of California. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction and significant equipment modernization projects. Research confirms 363 new projects identified in California during 2020.

The following are selected highlights on recent California industrial construction news and manufacturing capital projects.

Planned Industrial Construction in California by Project Type:

Manufacturing Facilities - 66 New Projects

Processing Facilities - 96 New Projects

Distribution and Industrial Warehouse - 153 New Projects

Power/Energy/Oil and Gas - 16 New Projects

Laboratory Facilities - 42 New Projects

Mine - 1 New Project

Data Center - 5 New Projects

Planned Industrial Construction in California by Scope/Activity

New Construction - 140 New Projects

Expansion - 64 New Projects

Renovations/Equipment Upgrades - 164 New Projects

Relocations - 71 New Projects

Plant Closing - 7 New Projects

Opportunities - By Equipment Need

Air Emissions Control Equipment - 148

Compressed Air Systems - 315

Control Systems and Instrumentation - 159

Conveyors - 177

Floor Coatings - 177

Material Handling/Storage Equipment - 230

Mechanical Construction - 300

Packaging Equipment - 113

Process Equipment - 80

Tanks/Vessels - 39

Largest Planned Industrial Construction Projects in California

During the year 2020, our research team identified 51 industrial construction projects in California with an estimated value of $25 million or more.

The largest project is owned by San Francisco Public Works, who is planning to invest $990 million for the renovation and equipment upgrades on their water treatment processing plant in SAN FRANCISCO, CA.

Top 10 Tracked Industrial Projects in California

Rodeo, CA

Energy company is planning to invest $750 million to repurpose their crude oil refinery into a renewable fuel processing facility in RODEO, CA. Completion is slated for early 2024.

Fairfield, CA

Federal defense agency is planning to invest $125 million for the construction of a warehouse, office, and aircraft maintenance hangar on their base in FAIRFIELD, CA. Completion is slated for June 2022.

Carlsbad, CA

Biotechnology company is planning to invest $110 million for the construction of a 140,000 sf laboratory and processing facility in CARLSBAD, CA. They expect to open in Summer 2021.

Los Angeles, CA

Airport authority is planning to invest $139 million for the construction of a 411,000 sf warehouse and maintenance hangar at 6010 W. Avion Dr. in LOS ANGELES, CA.

Gonzales, CA

Energy infrastructure company is planning to invest $70 million for the construction of a 35 MW microgrid system in GONZALES, CA. Construction is expected to start in Summer 2021, with completion slated for 2022.

San Bernardino, CA

Airport authority is planning to invest $75 million for the construction of a 1 million sf warehouse and distribution facility at their airport on Third St. in SAN BERNARDINO, CA.

Irvine, CA

Medical device mfr. is planning to invest $30 million for the expansion and equipment upgrades at their manufacturing facility in IRVINE, CA.

Oxnard, CA

Global online retailer is planning for the construction of a 1.5 million sf warehouse and distribution facility in OXNARD, CA. Completion is slated for late 2021.

Berkeley, CA

Pharmaceutical company is expanding and planning for the construction of 1 million sf of warehouse, office, laboratory, and processing facilities on their campus in BERKELEY, CA.

Santa Maria, CA

Cold storage service provider is planning for the construction of a 397,000 sf warehouse and distribution facility at 1750 East Betteravia Rd. in SANTA MARIA, CA.

Since 1959, SalesLeads, based out of Jacksonville, FL has been providing Industrial Project Reports on companies that are planning significant capital investments in their industrial facilities throughout North America. Our professional research team identifies new construction, expansion, relocation, major renovation, equipment upgrades, and plant closing project opportunities so that our clients can focus sales and marketing resources on the target accounts that have an impending need for their products, services, and indirect materials.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

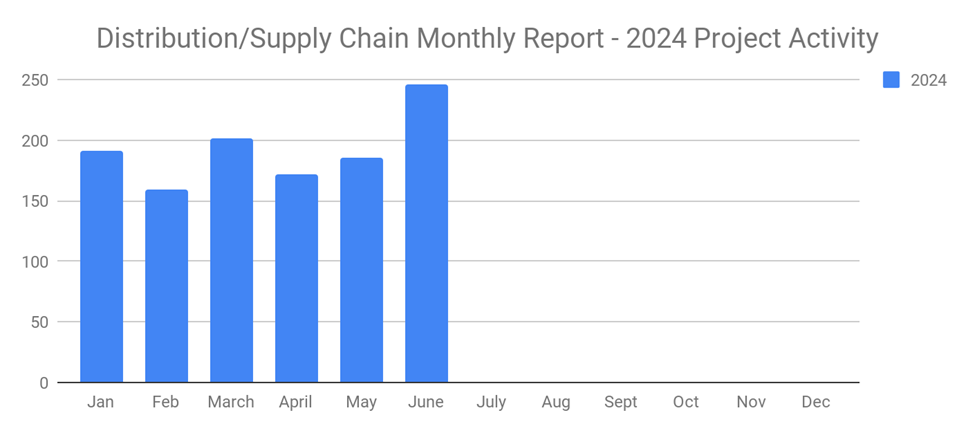

New Distribution and Supply Chain Industrial Projects Surge to 246 in June 2024

-

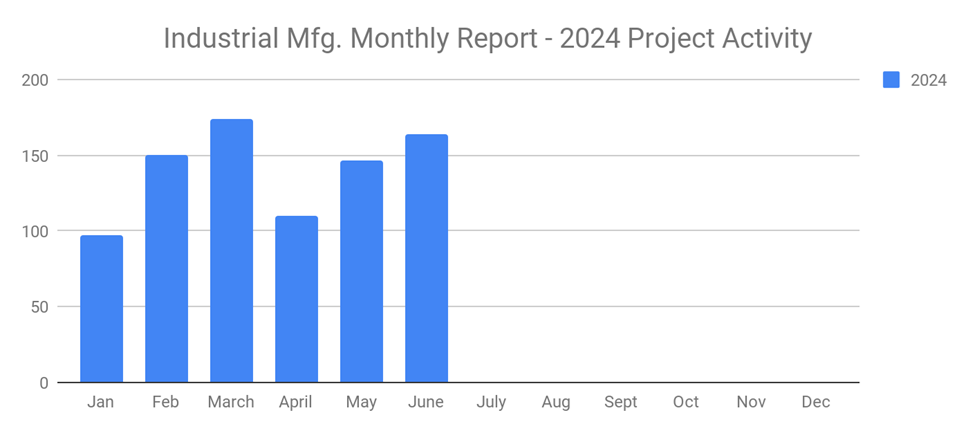

New Industrial Manufacturing Projects Third Month in a Row of Growth with 164 New Projects for June 2024

-

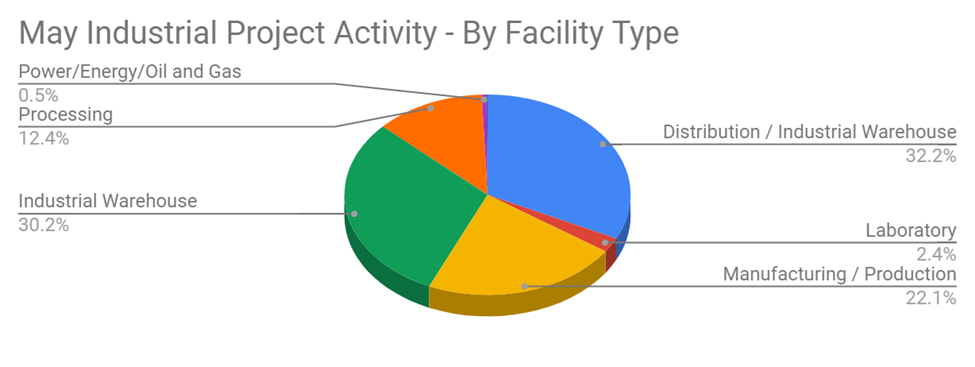

Planned Industrial Construction Projects Continue Strong in June 2024 with 496 New Projects

-

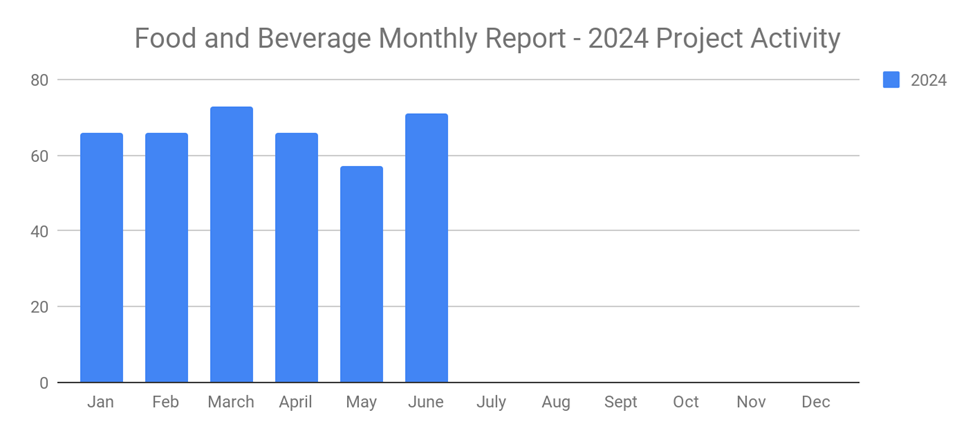

New Food and Beverage Planned Projects with Stellar Growth in June 2024 with 71 New Projects