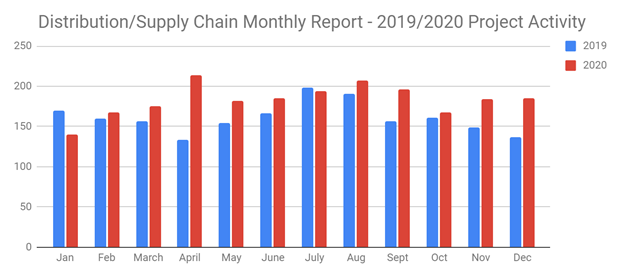

SalesLeads announced today the CY 2020 results for new planned capital project spending report for the Distribution and Supply Chain industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction and significant equipment modernization projects. Research confirms 2,198 new projects in the Industrial Manufacturing sector identified in 2020.

Planned industrial project activity within the sector increased by 12% from the previous year.

The following are selected highlights on new Distribution Center and Warehouse construction news.

Distribution and Supply Chain - By Project Type

Distribution/Fulfillment Centers- 612 New Projects

Industrial Warehouse – 1,823 New Projects

Distribution and Supply Chain- By Project Scope/Activity

New Construction – 1,055 New Projects

Expansion - 482 New Projects

Renovations/Equipment Upgrades - 691 New Projects

Plant Closing - 33 New Projects

Distribution and Supply Chain - By Project Location (Top 10 States)

Texas - 212

California - 153

Florida - 142

New York - 133

Ohio - 124

Indiana - 92

Illinois - 87

Pennsylvania - 86

North Carolina - 78

Tennessee - 75

YOY Growth by State

Research shows that Tennessee had the highest increase of Distribution and Industrial Warehouse projects tracked, with 35% more projects identified than in 2019. Conversely, Texas showed the largest decline of projects tracked, with a 5% decline compared to 2019.

Most Active Month

Research shows that the most active month was April, where 214 new Distribution and Supply Chain project opportunities we identified.

Largest Month to Month Increase in Projects Tracked

Research shows that there was a 18% increase in new projects tracked from March 2020 to April 2020. Conversely, Apr-May showed the largest month to month decline; with 214 new projects in April and 182 in May.

Opportunities - By Equipment Need

Conveyors – 1,373

Material Handling/Storage Equipment – 1,579

Lift Trucks – 1,594

Loading Dock Equipment – 1,461

Compressed Air Systems – 1,989

Control Systems and Instrumentation - 662

Floor Coatings – 1,306

Mechanical Construction - 1,835

Fire Suppression Equipment – 1,835

Networking/Security Equipment – 1,835

Largest Planned Project

During the year 2020, our research team identified 54 new Distribution and Supply Chain facility construction projects with an estimated value of $100 million of more.

The largest project is owned by Bureau of Engraving and Printing, who is planning to invest $1.4 billion for the construction of a 1 million sf warehouse and office facility in BELTSVILLE, MD. The project is in the early design stage.

Top 12 Largest Distribution and Supply Chain Projects

JANUARY

Federal defense agency is planning to invest $125 million for the construction of a warehouse, office, and aircraft maintenance hangar on their base in FAIRFIELD, CA.

FEBRUARY

Global online retailer is investing $295 million for the construction of a 645,000 sf distribution center in BONDURANT, IA.

MARCH

Commercial airline is planning to invest $550 million for a 325,000 sf expansion, renovation, and equipment upgrades on their aircraft hangar, warehouse, and office facilities at Tulsa International Airport in TULSA, OK

APRIL:

Biotechnology company is planning to invest $200 million for the construction of a 416,000 sf warehouse, processing, and laboratory facility in PLAINVILLE, MA.

MAY:

Global online retailer is investing $350 million for the construction of a 4 million sf distribution facility in CLAY, NY.

JUNE:

Cooperative food wholesaler is planning to invest $300 million for the construction of a 918,000 sf distribution facility in HERNANDO, MS. They will consolidate regional operations upon completion in Spring 2023.

JULY:

Aluminum can and glass bottle mfr. is planning to invest $366 million for the construction of a 908,000 sf manufacturing, warehouse, laboratory, and office facility in OLYPHANT, PA.

AUGUST:

Global online retailer is planning to invest $400 million for the construction of a 3.8 million sf distribution center in DETROIT, MI.

SEPTEMBER:

Food production company is planning to invest $314 million for the construction of a greenhouse, processing, and distribution complex in EARLY BRANCH, SC. Construction will occur in phases, with completion of the first phase slated for 2022.

OCTOBER:

LNG provider is planning to invest $542 million for the construction of a processing, warehouse, and office facility in JACKSONVILLE, FL.

NOVEMBER:

Federal agency is planning to invest $1.4 billion for the construction of a 1 million sf warehouse and office facility in BELTSVILLE, MD. The project is in the early design stage.

DECEMBER:

Online video streaming service provider is planning to invest $1 billion for an expansion of their warehouse, studio production, and office complex in ALBUQUERQUE, NM.

Since 1959, SalesLeads, based out of Jacksonville, FL has been providing Industrial Project Reports on companies that are planning significant capital investments in their industrial facilities throughout North America. Our professional research team identifies new construction, expansion, relocation, major renovation, equipment upgrades, and plant closing project opportunities so that our clients can focus sales and marketing resources on the target accounts that have an impending need for their products, services, and indirect materials.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

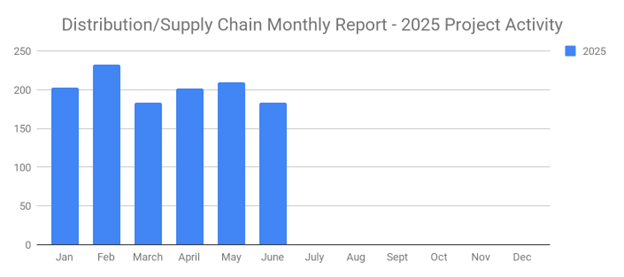

June's New Distribution and Supply Chain Planned Projects Return to March’s 183 Confirmed Figure

-

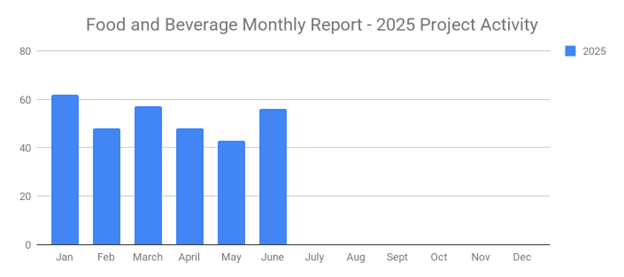

Food and Beverage Rebounds with 56 New Planned Projects Igniting Growth After Decline

-

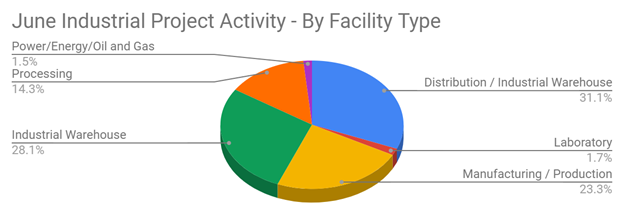

June 2025’s New Industrial Construction Projects Grew 7% Month-Over-Month

-

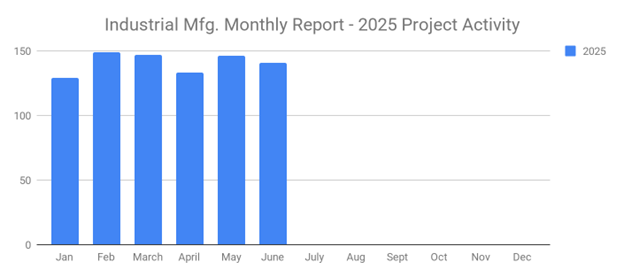

Q2 Industrial Manufacturing Soars 31% for Planned Projects Over $100M; June Planned Industrial Projects Hit 141