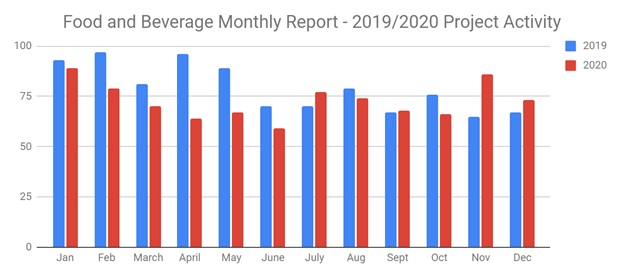

SalesLeads announced today the CY 2020 results for new planned capital project spending report for the Food and Beverage industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction and significant equipment modernization projects. Research confirms 872 new projects in the Food and Beverage sector identified in 2020.

Planned industrial project activity within the sector decreased by 9% from the previous year, 2019.

The following are selected highlights on new Food and Beverage industry construction news.

Food and Beverage Project Type

Processing Facilities - 631 New Projects

Distribution and Industrial Warehouse - 287 New Projects

Food and Beverage Project Scope/Activity

New Construction - 273 New Projects

Expansion - 248 New Projects

Renovations/Equipment Upgrades - 377 New Projects

Plant Closing - 25 New Projects

Food and Beverage Project Location (Top 10 States)

Texas - 57

California - 54

New York - 47

Ohio - 44

Florida - 31

Pennsylvania - 31

Georgia - 31

North Carolina - 31

Indiana - 29

Illinois - 28

YOY Growth by State

Research shows that North Carolina had the highest increase of projects tracked, with 26% more projects identified than in 2019. Conversely, California showed the largest decline of projects tracked, with a 48% decline compared to 2019.

Most Active Month

Research shows that the most active month was January, where 89 new projects opportunities were identified.

Largest Month to Month Increase in Projects Tracked

Research shows that there was a 23% increase in new projects tracked from October 2020 to November 2020. Conversely, Nov-Dec showed the largest month to month decline; with 86 new projects in November and 73 in June.

Opportunities - By Equipment Need

Air Emissions Control Equipment - 572

Compressed Air Systems - 728

Control Systems and Instrumentation - 544

Conveyors - 687

Floor Coatings - 451

Material Handling/Storage Equipment - 768

Mechanical Construction - 685

Packaging Equipment - 545

Process Equipment - 540

Tanks/Vessels - 348

Largest Planned Project

During the year 2020, our research team identified 28 new Food and Beverage facility construction projects with an estimated value of $100 million of more.

The largest project is owned by Nestle Purina Petcare, who is planning to invest $550 million for an expansion of their processing facility in HARTWELL, GA.

Top 12 Largest Food and Beverage Projects

JANUARY

Produce company is planning to invest $115 million for the expansion of their warehouse and processing facility in KENNETT SQUARE, PA by 900,000 sf. They have recently received approval for the project.

FEBRUARY

Seafood producer is investing $340 million for the expansion of their processing facility in MIAMI, FL by 1 million sf. Construction will occur in phases.

MARCH

Grocery retailer is planning to invest $420 million for the construction of a 600,000 sf distribution center in TERREBONNE, QC. Completion is slated for 2023.

APRIL:

Pet food mfr. is planning for a 2 million sf expansion, renovation, and equipment upgrades on their processing facility at 2500 Royal Windsor Dr. in MISSISSAUGA, ON.

MAY:

Food processing company is planning to invest $230 million for the construction of a chemical processing facility at their complex in EDDYVILLE, IA. The project also includes equipment upgrades on their existing facilities at the same location.

JUNE:

Cooperative food wholesaler is planning to invest $300 million for the construction of a 918,000 sf distribution facility in HERNANDO, MS. They will consolidate regional operations upon completion in Spring 2023.

JULY:

Seafood processor is planning to invest $300 million for the construction of a processing complex in FEDERALSBURG, MD. Construction will occur in three phases.

AUGUST:

Meat processing company is considering investing $200 million for the construction of a processing facility and currently seeking a site in COLORADO. Watch SalesLeads for updates.

SEPTEMBER:

Food production company is planning to invest $314 million for the construction of a greenhouse, processing, and distribution complex in EARLY BRANCH, SC. Construction will occur in phases, with completion of the first phase slated for 2022.

OCTOBER:

Pet food mfr. is planning to invest $550 million for the construction of a 1-million sf processing facility in WILLIAMSBURG TOWNSHIP, OH. Completion is slated for 2023.

NOVEMBER:

Beverage company is planning to invest $400 million for the construction of a 1-million sf production and distribution facility in COLUMBIA, SC. Completion is slated for Summer 2021.

DECEMBER:

Pet food mfr. is planning to invest $550 million for an expansion of their processing facility in HARTWELL, GA. They have recently received approval for the project.

Since 1959, SalesLeads, based out of Jacksonville, FL has been providing Industrial Project Reports on companies that are planning significant capital investments in their industrial facilities throughout North America. Our professional research team identifies new construction, expansion, relocation, major renovation, equipment upgrades, and plant closing project opportunities so that our clients can focus sales and marketing resources on the target accounts that have an impending need for their products, services, and indirect materials.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch