-

Posted On Wednesday, October 06, 2021 by Evan Lamolinara

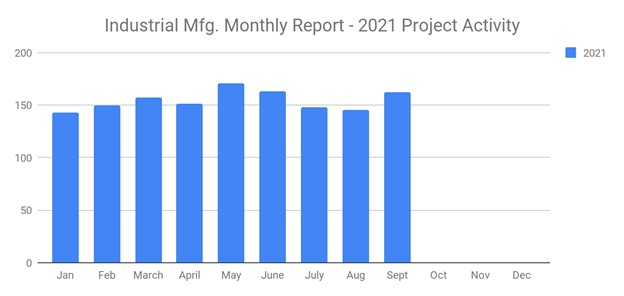

SalesLeads announced today the September 2021 results for the new planned capital project spending report for the Industrial Manufacturing industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction and significant equipment modernization projects. Research confirms 162 new projects in the Industrial Manufacturing sector.

The following are selected highlights on new Industrial Manufacturing industry construction news.

Industrial Manufacturing - By Project Type

Manufacturing/Production Facilities - 147 New Projects

Distribution and Industrial Warehouse - 54 New Projects

Industrial Manufacturing - By Project Scope/Activity

New Construction - 57 New Projects

Expansion - 48 New Projects

Renovations/Equipment Upgrades - 66 New Projects

Plant Closings - 12 New Projects

Industrial Manufacturing - By Project Location (Top 10 States)

Indiana - 14

Texas - 12

North Carolina - 9

Ohio - 8

Pennsylvania - 8

Michigan - 8

Tennessee - 7

Ontario - 7

Illinois - 7

California - 6

Largest Planned Project

During the month of September, our research team identified 15 new Industrial Manufacturing facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Ford Motor Company, who is planning to invest $5.6 billion for the construction of an EV automotive and battery manufacturing campus in MEMPHIS, TN. They are currently seeking approval for the project. Completion is slate for 2025.

Top 10 Tracked Industrial Manufacturing Projects

NEVADA:

Lithium ion battery recycling company is considering investing $1 billion for the construction of a 1 million sf manufacturing facility and currently seeking a site in the EASTERN NEVADA area. Watch SalesLeads for updates.

ALABAMA:

Automotive manufacturer is planning to invest $288 million for the renovation and equipment upgrades on their manufacturing facility in HUNTSVILLE, AL. They have recently received approval for the project.

MICHIGAN:

Automotive mfr. is planning to invest $250 million for the renovation and equipment upgrades at their manufacturing plants in DEARBORN, STERLING HEIGHTS, and YPSILANTI, MI. They have recently received approval for the project.

SOUTH DAKOTA:

Battery mfr. is planning to invest $250 million for the construction of a manufacturing and distribution complex in RAPID CITY, SD. Construction will occur in phases. They will relocate operations upon completion.

NORTH CAROLINA:

Fiber optic cable mfr. is planning to invest $150 million for the construction of a manufacturing facility in HICKORY, NC. They have recently received approval for the project.

TEXAS:

Paper products mfr. is planning to invest $120 million for the expansion, renovation, and equipment upgrades at their manufacturing facility in PINELAND, TX. Renovations are expected to start in early 2022, with completion slated for late 2022.

MAINE:

Paper products mfr. is planning to invest $111 million for the expansion and equipment upgrades of their manufacturing facility in RUMFORD, ME. They are currently seeking approval for the project.

VIRGINIA:

Aluminum extrusion mfr. is planning to invest $100 million for the expansion and equipment upgrades at their manufacturing facility in PRINCE GEORGE, VA. They have recently received approval for the project.

OHIO:

Recycled paper products mfr. is considering the construction of a paper mill and currently seeking a site in the SOUTHWESTERN, OH area. Watch SalesLeads for updates.

TEXAS:

Diversified industrial equipment mfr. is planning to invest $77 million for a 75,000 sf expansion and the renovation of their weather-damaged manufacturing and office facility in TYLER, TX. They have recently received approval for the project. Completion is slated for Spring 2022.

Since 1959, SalesLeads, based out of Jacksonville, FL has been providing Industrial Project Reports on companies that are planning significant capital investments in their industrial facilities throughout North America. Our professional research team identifies new construction, expansion, relocation, major renovation, equipment upgrades, and plant closing project opportunities so that our clients can focus sales and marketing resources on the target accounts that have an impending need for their products, services, and indirect materials.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

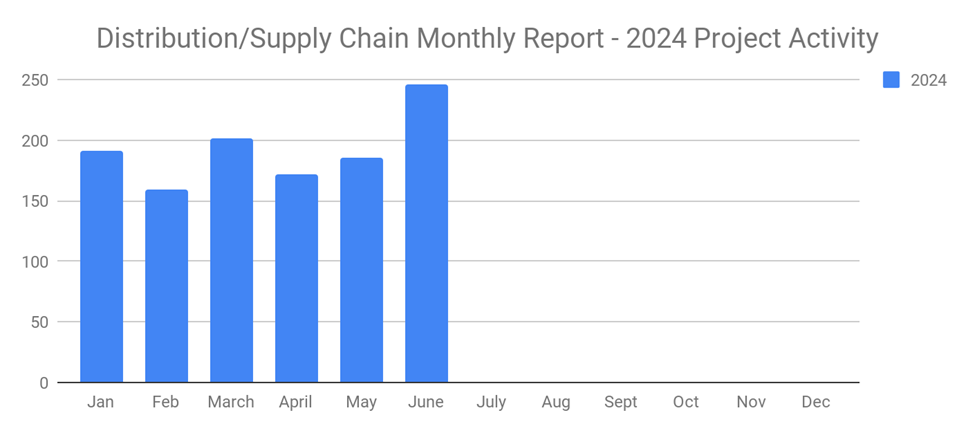

New Distribution and Supply Chain Industrial Projects Surge to 246 in June 2024

-

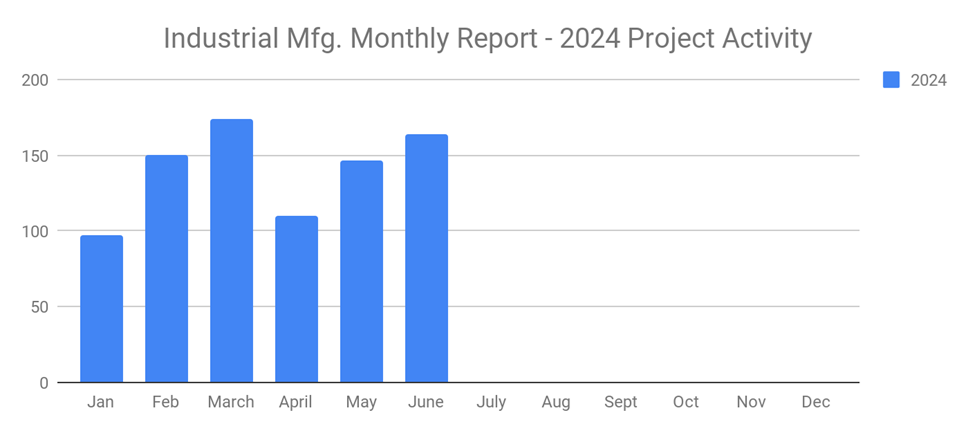

New Industrial Manufacturing Projects Third Month in a Row of Growth with 164 New Projects for June 2024

-

Planned Industrial Construction Projects Continue Strong in June 2024 with 496 New Projects

-

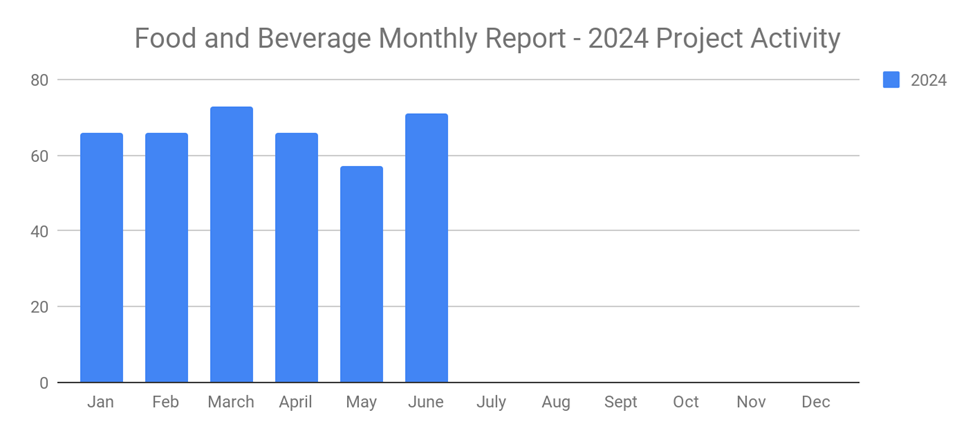

New Food and Beverage Planned Projects with Stellar Growth in June 2024 with 71 New Projects