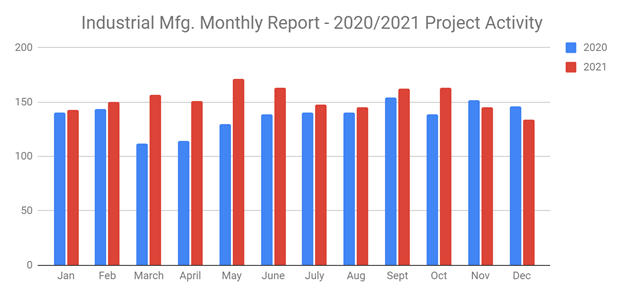

SalesLeads announced today the CY 2021 results for the new planned capital project spending report for the Industrial Manufacturing industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction and significant equipment modernization projects. Research confirms 1833 new projects in the Industrial Manufacturing sector identified in 2021.

Planned industrial project activity within the sector increased by 10% from the previous year.

The following are selected highlights on new Industrial Manufacturing industry construction news.

Industrial Manufacturing - By Project Type

Manufacturing/Production Facilities - 1629 New Projects

Distribution and Industrial Warehouse - 691 New Projects

Industrial Manufacturing - By Project Scope/Activity

New Construction - 569 New Projects

Expansion - 661 New Projects

Renovations/Equipment Upgrades - 747 New Projects

Plant Closing - 93 New Projects

Industrial Manufacturing - By Project Location (Top 10 States)

Texas - 109

North Carolina - 108

Indiana - 106

Ohio - 104

New York - 88

Michigan - 86

California - 84

Wisconsin - 76

Ontario - 74

Pennsylvania - 73

YOY Growth by State

Research shows that Ontario state had the highest increase of Industrial Manufacturing projects tracked, with 32% more projects identified than in 2020. Conversely, Kansas state showed the largest decline of projects tracked, with a 65% decline compared to 2020.

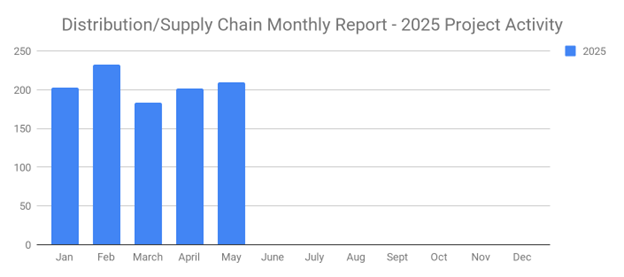

Most Active Month

Research shows that the most active month was May, where 171 new Industrial Manufacturing project opportunities were identified.

Largest Month to Month Increase in Projects Tracked

Research shows that there was a 12% increase in new projects tracked from April 2021 to May 2021. Conversely, Oct-Nov showed the largest month to month decline; with 163 new projects in October and 145 in November.

Opportunities - By Equipment Need

Manufacturing Equipment - 1396

Air Emissions Control Equipment - 1677

Compressed Air Systems - 1677

Control Systems and Instrumentation - 1566

Conveyors - 1566

Cranes and Hoists - 1350

Floor Coatings - 1065

Material Handling/Storage Equipment - 1724

Packaging Equipment - 1457

Equipment Relocation - 252

Largest Planned Project

During the year 2021, our research team identified 143 new Industrial Manufacturing facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Intel Corporation, who is planning to invest $20 billion for the construction of two manufacturing facilities at their manufacturing complex in CHANDLER, AZ. Completion is slated for 2024.

Top 12 Largest Industrial Manufacturing Projects

JANUARY

Global electronics mfr. is considering investing $10 billion for the construction of a manufacturing facility in AUSTIN, TX.

FEBRUARY

Solar panel mfr. is planning to invest $650 million for the construction of a 500,000 sf manufacturing facility at Route 12F in WATERTOWN, NY. Construction will occur in phases and is expected to start in early 2022.

MARCH

Technology company is expanding and planning to invest $20 billion for the construction of two manufacturing facilities at their manufacturing complex in CHANDLER, AZ. Completion is slated for 2024.

APRIL:

Automobile mfr. is planning to invest $2.3 billion for the construction of an EV battery manufacturing facility adjacent to their existing plant in SPRING HILL, TN. Completion is slated for late 2023.

MAY:

Technology company is planning to invest $3.5 billion for the renovation and equipment upgrades on their manufacturing facility in RIO RANCHO, NM. Completion is slated for late 2022.

JUNE:

Solar panel mfr. is planning to invest $680 million for the expansion of their manufacturing facility in LAKE TOWNSHIP, OH by 2 million sf. They are currently seeking approval for the project. Completion is slated for 2023.

JULY:

Global electronics mfr. is planning to invest $17 billion for the construction of a 6 million sf manufacturing facility in TAYLOR, TX. They are currently seeking approval for the project. Construction is expected to start in early 2022, with completion slated for late 2024.

AUGUST:

EV mfr. is considering investing $5 billion for the construction of a 12 million sf manufacturing facility and currently seeking a site in the FORT WORTH, TX area.

SEPTEMBER:

Automotive mfr. is planning to invest $5.6 billion for the construction of an EV automotive and battery manufacturing campus in MEMPHIS, TN. They are currently seeking approval for the project. Completion is slate for 2025.

OCTOBER:

Automotive mfr. is planning to invest $5.8 billion for the construction of two EV automotive and battery manufacturing facilities in GLENDALE, KY. They are currently seeking approval for the project. Completion is slated for 2025 and 2026.

NOVEMBER:

Semiconductor equipment mfr. is planning to invest $473 million for the construction of a manufacturing facility at 3000 SKC Dr. in COVINGTON, GA. Completion is slated for Fall 2023.

DECEMBER:

Automotive mfr. is planning to invest $3 billion for the construction of a battery manufacturing facility in LIBERTY, NC. They have recently received approval for the project. Completion is slated for 2025.

About SalesLeads, Inc.

Since 1959, SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team.

Each month, our team delivers hundreds of industrial capital project intelligence reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch