SalesLeads announced today the CY 2021 results for the new planned capital project spending report for the Food and Beverage industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction and significant equipment modernization projects. Research confirms 813 new projects in the Food and Beverage sector identified in 2021.

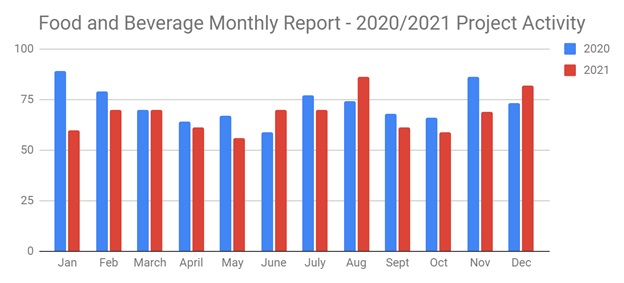

Planned industrial project activity within the sector decreased by 7% from the previous year.

The following are selected highlights on new Food and Beverage industry construction news.

Food and Beverage Project Type

Processing Facilities - 620 New Projects

Distribution and Industrial Warehouse - 239 New Projects

Food and Beverage Project Scope/Activity

New Construction - 310 New Projects

Expansion - 219 New Projects

Renovations/Equipment Upgrades - 337 New Projects

Plant Closing - 31 New Projects

Food and Beverage Project Location (Top 10 States)

Texas - 51

California - 46

New York - 46

Ohio - 40

Pennsylvania - 38

Florida - 32

Wisconsin - 31

Indiana - 30

Georgia - 30

Missouri - 28

YOY Growth by State

Research shows that Missouri state had the highest increase of projects tracked, with 54% more projects identified than in 2020. Conversely, Kentucky state showed the largest decline of projects tracked, with a 85% decline compared to 2020.

Most Active Month

Research shows that the most active month was August, where 86 new projects opportunities were identified.

Largest Month to Month Increase in Projects Tracked

Research shows that there was a 20% increase in new projects tracked from May 2021 to June 2021. Conversely, Aug-Sep showed the largest month to month decline; with 86 new projects in August and 61 in September.

Opportunities - By Equipment Need

Air Emissions Control Equipment - 567

Compressed Air Systems - 739

Control Systems and Instrumentation - 588

Conveyors - 659

Floor Coatings - 431

Material Handling/Storage Equipment - 760

Mechanical Construction - 666

Packaging Equipment - 518

Process Equipment - 508

Tanks/Vessels - 315

Largest Planned Project

During the year 2021, our research team identified 52 new Food and Beverage facility construction projects with an estimated value of $100 million or more.

The largest project is owned by J.M. Smucker Company, who is planning to invest $1 billion for the construction of a processing facility in MCCALLA, AL. Construction will occur in phases and is expected to start in early 2022, with completion slated for 2025.

Top 12 Largest Food and Beverage Projects

JANUARY

Pet food mfr. is planning to invest $145 million for a 200,000 sf expansion and equipment upgrades of their processing facility in FORT SMITH, AR. They have recently received approval for the project. Completion is slated for 2022.

FEBRUARY

Cheese mfr. is planning to invest $500 million for the construction of a 486,000 sf processing facility in BELVIDERE, NY.

MARCH

Pet food mfr. is planning to invest $390 million for the construction of a processing facility at 6574 OH-503 in LEWISBURG, OH. They have recently received approval for the project. Completion is slated for Fall 2023.

APRIL:

Winery is planning to invest $400 million for the construction of a production facility in FORT LAWN, SC. They are currently seeking approval for the project.

MAY:

Dairy products mfr. is planning to invest $460 million for the construction of a processing facility in DODGE CITY, KS. Completion is slated for 2024.

JUNE:

Startup meat processing company is planning to invest $325 million for the construction of a processing facility in MILLS COUNTY, IA. Construction is expected to start in Spring 2022, with completion slated for late 2023.

JULY:

Beverage company is planning to invest $740 million for the construction of a 2 million sf processing and distribution facility in CONCORD, NC. They have recently received approval for the project.

AUGUST:

Specialty food products mfr. is planning to invest $415 million for the expansion, renovation, and equipment upgrades on their processing facility in AMERICAN FALLS, ID. Completion is slated for Summer 2023.

SEPTEMBER:

Startup soybean processing company is planning to invest $350 million for the construction of a processing facility in ALTA, IA. They are currently seeking approval for the project. Completion is slated for early 2024.

OCTOBER:

Specialty dairy products mfr. is planning to invest $870 million for the construction of a processing facility in LUBBOCK, TX. They have recently received approval for the project.

NOVEMBER:

Specialty food products mfr. is planning to invest $1 billion for the construction of a processing facility in MCCALLA, AL. Construction will occur in phases and is expected to start in early 2022, with completion slated for 2025.

DECEMBER:

Distillery is planning to invest $400 million for the construction of a production facility in CHARLESTOWN, IN. They are currently seeking approval for the project.

About SalesLeads, Inc.

Since 1959, SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team.

Each month, our team delivers hundreds of industrial capital project intelligence reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

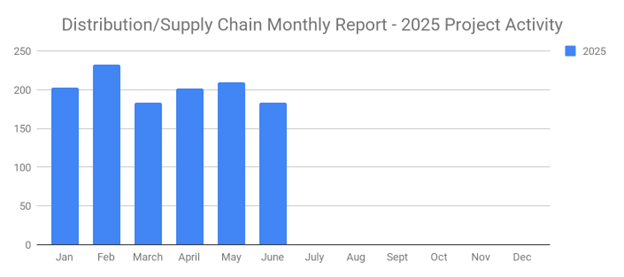

June's New Distribution and Supply Chain Planned Projects Return to March’s 183 Confirmed Figure

-

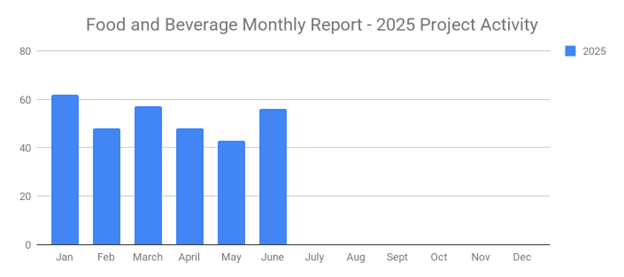

Food and Beverage Rebounds with 56 New Planned Projects Igniting Growth After Decline

-

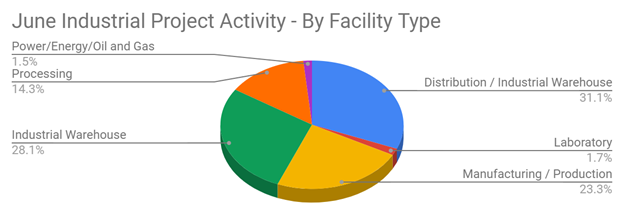

June 2025’s New Industrial Construction Projects Grew 7% Month-Over-Month

-

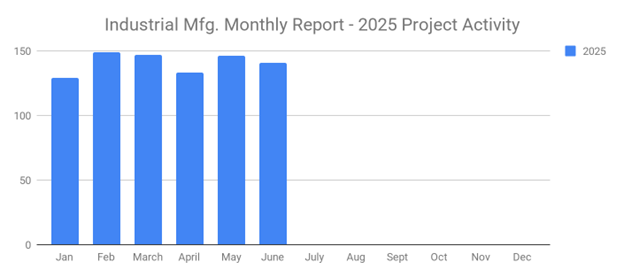

Q2 Industrial Manufacturing Soars 31% for Planned Projects Over $100M; June Planned Industrial Projects Hit 141