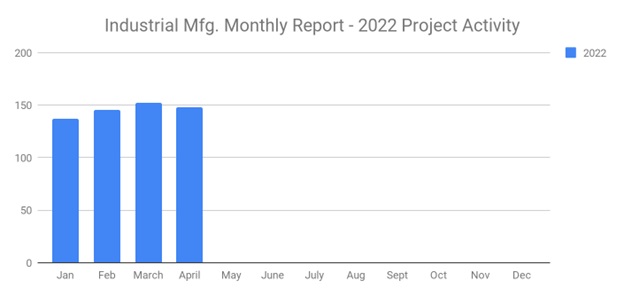

Industrial SalesLeads, through its Industrial Market Intelligence (IMI) platform, has released its April 2022 results for planned industrial manufacturing capital spending across the U.S. and Canada. This month’s report confirms 148 new industrial manufacturing projects, highlighting the steady momentum in North American CapEx investments for manufacturing facility expansions, new plant construction, equipment modernizations, and retrofits.

Why Manufacturing CapEx Investment Remains Strong

Despite supply chain challenges and inflationary pressures, manufacturers continue to push forward with major investments. The need to localize supply chains, adopt advanced manufacturing automation, and meet increased product demand has driven steady growth in new greenfield construction, facility expansions, and large-scale equipment upgrades.

Greenfield construction: refers to building a new facility on undeveloped land, providing companies a blank slate for modern, efficient manufacturing operations.

The following are selected highlights on new Industrial Manufacturing industry construction news.

Industrial Manufacturing Projects — By Project Type

The April 2022 report breaks down the 148 new industrial projects as follows:

-

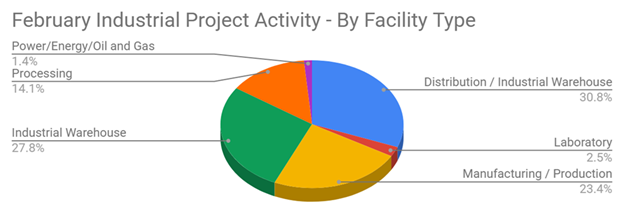

Manufacturing & Production Facilities: 130 projects

-

Distribution & Industrial Warehouses: 56 projects

This trend reflects the continued expansion of U.S. and Canadian supply chains, including the rise of onshoring initiatives, which boost local production capacity and reduce reliance on overseas facilities.

Project Scope & Activities

SalesLeads’ data also segments projects by scope:

-

New Construction: 55 projects

-

Facility Expansions: 51 projects

-

Renovations & Equipment Modernization: 46 projects

-

Plant Closings: 11 projects

Q: “Why are plant closing reports included?

A: Tracking plant closures helps sales teams identify surplus equipment sales, relocation projects, or new opportunities for redevelopment.

Largest Industrial Manufacturing Projects in April 2022

Of the 148 projects tracked, 17 are valued at $100 million or more, reflecting substantial commitments to large-scale production growth and advanced manufacturing capabilities.

The largest project is VinFast Auto US’s planned $4 billion manufacturing and distribution facility in Moncure, NC, currently pending approval. This massive greenfield development will create significant opportunities for contractors, equipment suppliers, and service providers specializing in automotive production facilities.

Top States & Provinces for New Manufacturing Projects

For sales teams targeting regional opportunities, the top 10 locations for new industrial manufacturing projects this month are:

-

New York: 13 projects

-

California: 11 projects

-

Michigan: 11 projects

-

Ontario: 9 projects

-

Indiana: 8 projects

-

Ohio: 8 projects

-

South Carolina: 8 projects

-

Texas: 8 projects

-

Minnesota: 5 projects

-

North Carolina: 5 projects

These regions continue to attract strong CapEx spending for industrial facility development, expansions, and equipment upgrades.

Selected Highlights: Top 10 Tracked Projects

KY: $2 billion EV battery manufacturing plant in Bowling Green

KS: $650 million biotech processing facility in Manhattan

CA: $350 million steel fabrication plant in Mojave

AL: $300 million automotive facility expansion in Montgomery

TX: $200 million paper products facility renovation in Cedar Hill

NC: $118 million building materials plant expansion in Oxford

MO: $109 million automotive facility upgrade in Troy

AR: $80 million flexible packaging facility in Searcy

GA: $44 million horticultural container plant in Lyons

SC: $34.5 million automotive glass expansion in Fountain Inn

Each of these projects offers opportunities for industrial equipment sales, automation integration, material handling solutions, and outsourced prospecting to engage key decision-makers early in the CapEx planning process.

How Industrial SalesLeads Helps You Close More Industrial Deals

Since 1959, Industrial SalesLeads has helped thousands of industrial suppliers, contractors, and service companies grow predictable sales pipelines with accurate, actionable project intelligence. Our Industrial Market Intelligence (IMI) reports give you verified details on new construction, expansions, retrofits, and facility modernizations — along with key contacts to help you set qualified appointments faster.

Whether you sell industrial equipment, automation systems, construction services, or logistics solutions, our targeted project reports keep your sales and marketing teams ahead of the competition.

About SalesLeads, Inc.

Since 1959, SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team.

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

Want early access to upcoming industrial projects?

📞 Contact us today to learn how our Outsourced Prospecting Services and Industrial Market Intelligence Reports can fill your pipeline with qualified opportunities in the manufacturing, energy, and industrial sectors.

What to learn more? Get in Touch

Latest Posts

-

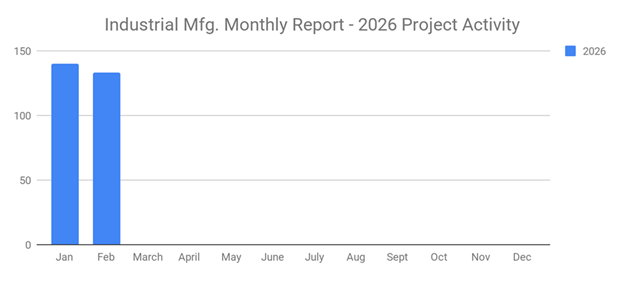

Renovations and Equipment Upgrades Fell 18% in February 2026; Other Capital Projects Remain Stable

-

Planned Industrial Construction Projects Fell 7% MoM

-

Food and Beverage Industry Posts Modest Growth with 50 New Planned Projects in February 2026

-

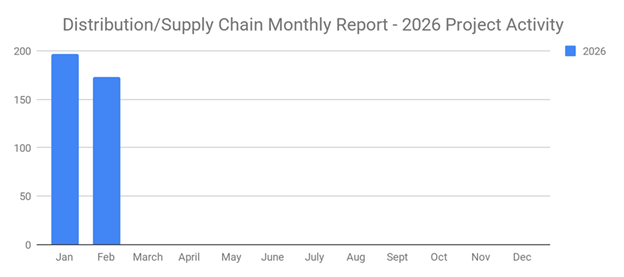

Distribution and Supply Chain Planned Industrial Projects Continue Decline at 12% MoM February 2026