-

Posted On Wednesday, October 05, 2022 by Evan Lamolinara

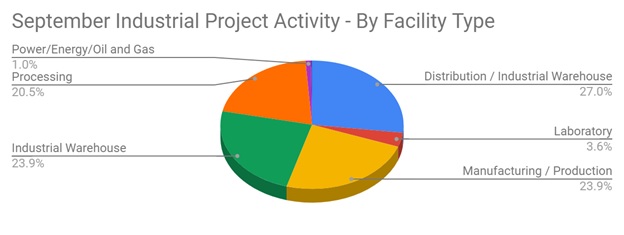

Research by IMI SalesLeads’ experienced industrial market research team, shows 431 new planned industrial projects tracked during the month of September. The 431 new construction developments are also down from 445 in September 2021.

Planned industrial project activity decreased 1% from the previous month.

The following are selected highlights on new industrial construction news and project opportunities throughout North America.

Planned Industrial Construction - By Project Type:

Manufacturing Facilities - 147 New Projects

Processing Facilities - 126 New Projects

Distribution and Industrial Warehouse - 166 New Projects

Power/Energy/Oil and Gas - 6 New Projects

Laboratory Facilities - 22 New Projects

Mine - 1 New Project

Terminal - 0 New Projects

Pipeline - 0 New Projects

Planned Industrial Construction - By Scope/Activity

New Construction - 195 New Projects

Expansion - 98 New Projects

Renovations/Equipment Upgrades - 144 New Projects

Plant Closing - 24 New Projects

Planned Industrial Construction - By Location (Top 10 States)

Texas - 32

New York - 23

Ohio - 23

California - 21

Indiana - 21

Minnesota - 19

Wisconsin - 16

North Carolina - 15

Florida - 14

Georgia - 14

Largest Planned Industrial Construction Project

During the month of September, our research team identified 26 new General Industrial facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Micron Technology, Inc., who is planning to invest $15 billion for the construction of a manufacturing facility in BOISE, ID. They are currently seeking approval for the project.

Top 10 Tracked Industrial Construction Projects

NORTH CAROLINA:

Semiconductor mfr. is planning to invest $5 billion for the construction of a manufacturing campus in SILER CITY, NC. They are currently seeking approval for the project.

MICHIGAN:

Battery component mfr. is planning to invest $3.6 billion for the construction of a manufacturing facility on 18 Mile Rd. in BIG RAPIDS, MI. They are currently seeking approval for the project.

NORTH CAROLINA:

Automotive mfr. is planning to invest an additional $2.5 billion for the construction of an EV battery manufacturing facility in LIBERTY, NC. Completion is slated for 2025.

OHIO:

Automotive mfr. is planning to invest $760 million for the renovation and equipment upgrades at their manufacturing facility in TOLEDO, OH. They have recently received approval for the project.

KENTUCKY:

Automotive mfr. is planning to invest $700 million for the renovation and equipment upgrades at their manufacturing facility in LOUISVILLE, KY. They have recently received approval for the project.

TENNESSEE:

Lithium producer is planning to invest $582 million for the construction of a processing facility in ETOWAH, TN. They are currently seeking approval for the project.

INDIANA:

Automotive mfr. is expanding and planning to invest $491 million for a 6,000 sf expansion, renovation, and equipment upgrades on their manufacturing facility in MARION, IN. They are currently seeking approval for the project. Construction is expected to start in early 2023.

MICHIGAN:

Semiconductor mfr. is planning to invest $375 million for the expansion, renovation, and equipment upgrades on their manufacturing facility in THOMAS TOWNSHIP, MI. They are currently seeking approval for the project.

TEXAS:

EV mfr. is planning to invest $365 million for the construction of a lithium-hydroxide refining plant in ROBSTOWN, TX. They are currently seeking approval for the project. Construction is expected to start in late 2022, with completion slated for 2024.

ARIZONA:

Plant-based packaging product mfr. is planning to invest $280 million for the renovation and equipment upgrades on their manufacturing facility in GILBERT, AZ. Completion is slated for late 2023.

About SalesLeads, Inc.

Since 1959, SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team.

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

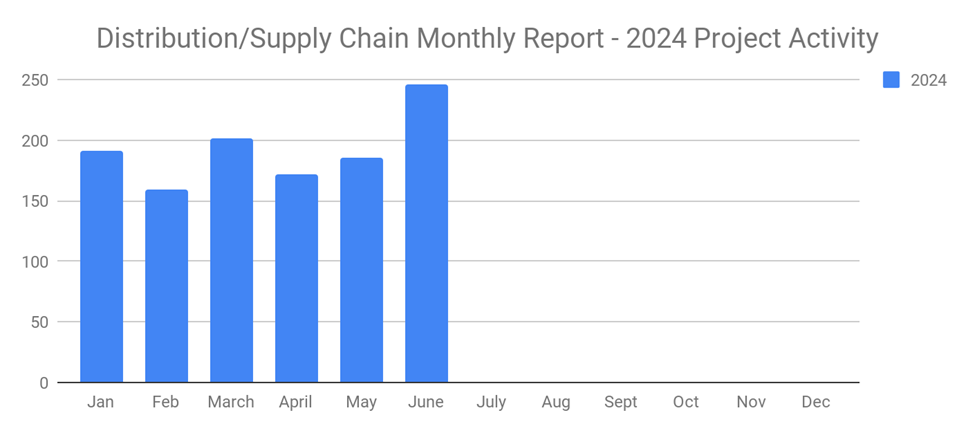

New Distribution and Supply Chain Industrial Projects Surge to 246 in June 2024

-

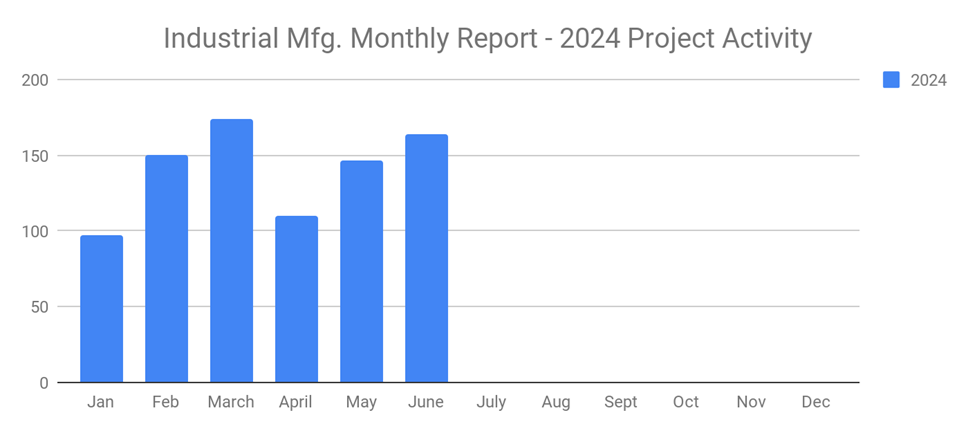

New Industrial Manufacturing Projects Third Month in a Row of Growth with 164 New Projects for June 2024

-

Planned Industrial Construction Projects Continue Strong in June 2024 with 496 New Projects

-

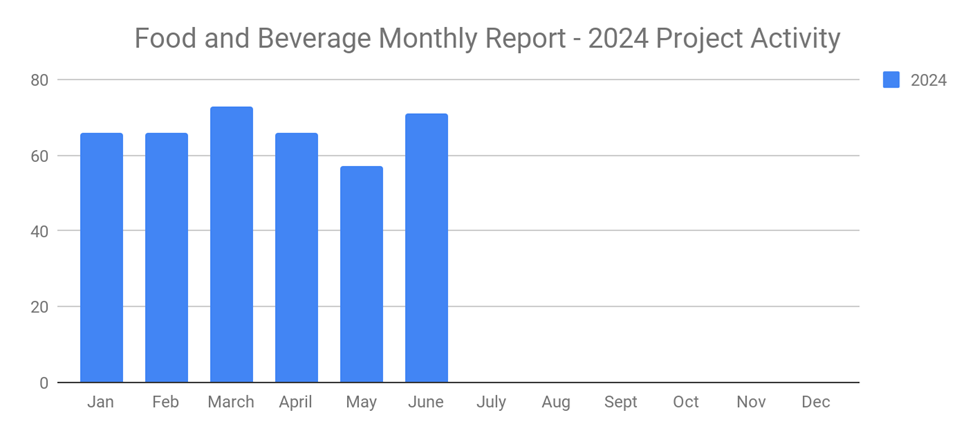

New Food and Beverage Planned Projects with Stellar Growth in June 2024 with 71 New Projects