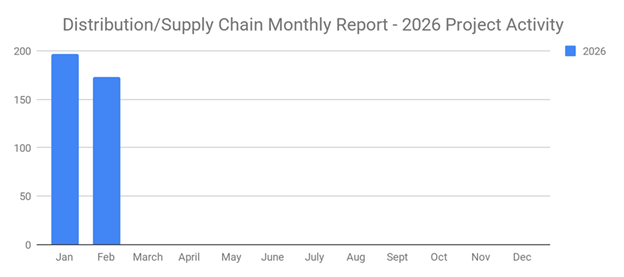

Industrial SalesLeads, through its Industrial Market Intelligence (IMI) platform, has released its February 2023 results for planned capital spending in the Distribution & Supply Chain sector across North America. Research confirms 166 new industrial distribution and supply chain projects, with a notable 10% increase in new construction compared to the previous month with Texas leading the way with 16 projects.

Despite supply chain constraints and labor challenges, companies continue to invest heavily in new distribution centers, fulfillment facilities, and industrial warehouse expansions to meet growing logistics and e-commerce demands.

Distribution & Supply Chain: covers facilities used to store, handle, and transport products between manufacturers, retailers, and end-users.

The following are selected highlights on new Distribution Center and Warehouse construction news.

📊 Project Breakdown — By Type

-

Distribution & Fulfillment Centers: 16 new projects

-

Industrial Warehouses: 153 new projects

The surge in warehouse development aligns with companies seeking to shorten delivery times and optimize last-mile logistics.

🏗️ Project Scope & Activity

-

New Construction: 95 projects

-

Facility Expansions: 35 projects

-

Renovations & Equipment Upgrades: 35 projects

-

Closings: 4 projects

Q: Why are closings tracked?

A: Knowing about facility closures can help industrial sales teams target new tenants, site redevelopments, or surplus asset sales.

🗺️ Top States for New Distribution & Supply Chain Projects

States with the highest activity in February:

-

Texas: 16 projects

-

Wisconsin: 11 projects

-

California: 9 projects

-

Ohio: 9 projects

-

Iowa: 8 projects

💰 Largest Projects This Month

Among the 166 tracked, 3 major projects exceed $100 million:

-

Graphic Packaging International, LLC plans to invest $1 billion to build a 640,000 sf paperboard recycling facility in Waco, TX (construction starts Spring 2023).

-

Other large-scale opportunities span film production warehouse complexes, grocery distribution hubs, and logistics service provider expansions.

🏆 Selected Highlights: Top 10 Tracked Projects

-

NY: $400M film/TV production warehouse in Brooklyn

-

SC: $50M appliance distribution center renovation in Greenville

-

ME: $33M federal warehouse at Acadia National Park

-

WI: 1.4M sf distribution center in Kenosha

-

PA: 1.2M sf grocery retail DC in Fairless Hills

-

TX: 1M sf medical apparel distribution center in Dallas

-

MO: Two new warehouses totaling 800,000 sf in Kansas City

-

NC: 402,000 sf logistics facility renovation in Greensboro

-

NH: 378,000 sf apparel warehouse/office in Hudson

-

KY: 200,000 sf logistics warehouse renovation in Covington

📈 Why This Matters for Industrial Sales Teams

This report illustrates strong momentum in North American logistics, warehousing, and distribution CapEx investments, opening doors for industrial equipment suppliers, MRO, racking, automation systems, and outsourced prospecting teams.

Since 1959, Industrial SalesLeads has delivered trusted industrial project intelligence to help sales and marketing teams build a predictable, scalable pipeline of verified opportunities.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

Want early access to future project reports?

📞 Contact us today to learn how Outsourced Prospecting Services and the Industrial Market Intelligence (IMI) platform can generate qualified appointments and sales conversations for your distribution, logistics, and supply chain solutions.

What to learn more? Get in Touch

Latest Posts

-

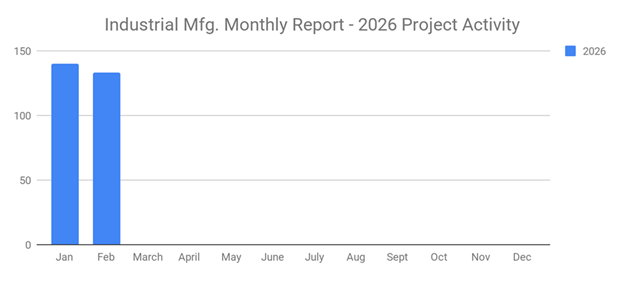

Renovations and Equipment Upgrades Fell 18% in February 2026; Other Capital Projects Remain Stable

-

Planned Industrial Construction Projects Fell 7% MoM

-

Food and Beverage Industry Posts Modest Growth with 50 New Planned Projects in February 2026

-

Distribution and Supply Chain Planned Industrial Projects Continue Decline at 12% MoM February 2026