It’s easy to feel like a small fish in the B2B industrial market. Larger companies often dominate with bigger budgets, wider product lines, and deeper benches. But “bigger” isn’t the same as “better,” especially in industrial buying where responsiveness, expertise, and execution matter.

Here are practical strategies smaller industrial firms can use to compete and win.

Q: Can a small industrial company really compete with large competitors?

A: Yes. Smaller firms win by specializing, responding faster, reducing buyer risk with proof, and targeting accounts with active initiatives.

Niche specialization: Focusing on a specific segment, use case, or capability where you can win on expertise.

Differentiation: The reason a buyer chooses you instead of an alternative (speed, proof, expertise, service, risk reduction).

1) Niche Specialization (Win by being the obvious choice)

Competing head-to-head on breadth is a trap. Smaller firms win by being the best option for a specific niche: a segment, process, environment, spec, compliance need, or service model.

Ways to niche down in industrial

-

Industry focus (food & beverage, pharma, chemicals, aerospace)

-

Use case focus (sanitation upgrades, automation retrofit, safety compliance)

-

Spec focus (materials, tolerances, uptime requirements, lead time)

-

Geography focus (regional service, faster onsite response)

When you’re the specialist, you’re compared less on price and more on fit.

Q: What’s the best first step to compete against big companies?

A: Tighten your positioning. Define your niche, ideal customer profile, and the specific problems you solve better than generalist competitors.

Ideal customer profile (ICP): The type of account most likely to buy and succeed with your offering.

2) Personalized Customer Service (Win with attention and follow-through)

Big companies often struggle to provide individualized attention. Smaller firms can build stronger relationships by being easier to work with and faster to respond.

What “better service” looks like in B2B industrial

-

Faster quotes and clearer lead times

-

Real problem diagnosis (not generic answers)

-

Consistent communication during delivery and install

-

Proactive follow-up and support after the sale

Many buyers will pay more for lower risk and better reliability.

Q: How do small firms avoid competing only on price?

A: Sell risk reduction: faster response, better outcomes, clearer timelines, compliance confidence, and evidence from similar projects.

Buyer risk: The operational, financial, or compliance downside the buyer is trying to avoid.

3) Speed and Agility (Win by moving first)

Large organizations have inertia. Smaller firms can win by reacting faster to customer needs and market changes.

Agility plays

-

Same-day response for inbound leads

-

Rapid quoting on defined SKUs or common projects

-

Flexible scheduling and phased delivery

-

Quick pilots or proof-of-concept installs

Speed creates confidence and prevents competitors from “setting the frame” first.

Q: What role does timing play in winning industrial deals?

A: Timing is huge. If you engage when a plant is planning upgrades or expansion, you’re not “cold calling,” you’re relevant.

Proof assets: Case studies, references, outcomes, certifications, and project summaries that reduce uncertainty.

4) Proof and Trust (Win by reducing buyer risk)

In B2B industrial, the buyer is often managing risk: uptime, safety, compliance, and reputational exposure. Proof beats hype.

Trust-building assets that work

-

Short case studies with measurable outcomes

-

Before/after photos and project summaries

-

Spec sheets, certifications, and compliance notes

-

References in similar plants or verticals

If you don’t have giant brand recognition, you build trust with evidence.

Q: How can Industrial SalesLeads help?

A: Industrial SalesLeads helps you identify companies with active projects so you focus outreach on accounts that are most likely to buy.

Targeting and timing: Focusing sales effort on accounts that have active initiatives and are most likely to buy now.

5) Strategic Partnerships (Win by expanding capability)

Partnerships let you compete for larger projects without pretending you’re something you’re not.

Examples

-

Integrators, installers, and service partners

-

Complementary manufacturers or distributors

-

Regional partners for coverage and response

-

Specialists for compliance, safety, or controls

The goal is to be able to say “yes” confidently, with a credible team behind it.

6) Targeting and Timing (Win by focusing on accounts that are actually buying)

Most small companies lose to big companies because they spend time chasing the wrong accounts. The fastest way to compete is to target companies that have active projects, planned upgrades, or expansion activity.

If you know who is building, expanding, retrofitting, or modernizing equipment, you can focus sales effort where it has a chance of converting.

7) Online Presence and Content (Win the research phase)

Industrial buyers research before they reach out. Your website should quickly answer: what you do, who it’s for, where you operate, and why you’re the safer choice.

B2B industrial online basics

-

Clear offerings and industries served

-

Proof (projects, certifications, outcomes)

-

Search-optimized pages for your core niches

-

Content that answers common buying questions

How Industrial SalesLeads Helps You Compete

Industrial SalesLeads helps B2B teams identify companies with active initiatives, expansion plans, and project activity so you can prioritize the accounts most likely to buy. When you target the right companies at the right time, you reduce wasted outreach, improve conversion rates, and win more deals, even when you’re competing against larger brands.

SalesLeads offers programs tailored to the industrial marketplace:

1) Industrial Market Intelligence (IMI)

Our IMI service provides actionable industrial project reports and business opportunity leads each month. You receive project contact information so you know who to reach out to to begin the sales cycle. Choose a specific state, region, or nationwide coverage.

2) Prospecting Services

Our prospecting services deliver tailored industrial lead generation and strategic appointment setting. We help identify the right companies and generate the sales opportunities your team needs to keep the pipeline moving.

Key Takeaways

-

Don’t compete on breadth. Compete on fit, speed, and proof.

-

Specialists are compared less on price and more on risk reduction.

-

Partnerships expand capability without bloating overhead.

-

Targeting and timing are a force multiplier for smaller teams.

-

Strong proof assets shorten sales cycles and increase win rates.

What to learn more? Get in Touch

Latest Posts

-

How Strategic B2B Marketing Supports Industrial Sales Success

-

Moving Beyond Volume: 3 Big Strategies for Developing Industrial Leads

-

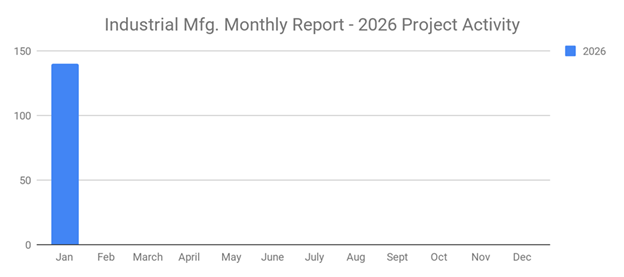

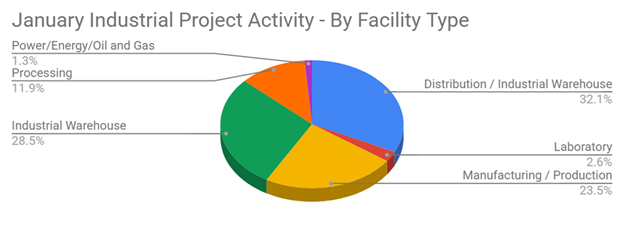

January 2026 Surges with a 22% Increase in New Industrial Projects Erasing December’s Decline of 20%

-

Planned Industrial Construction Projects Start January 2026 Strong with an Increase of 3% from the Previous Month