TL;DR

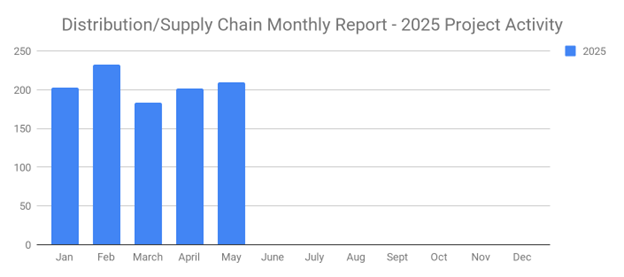

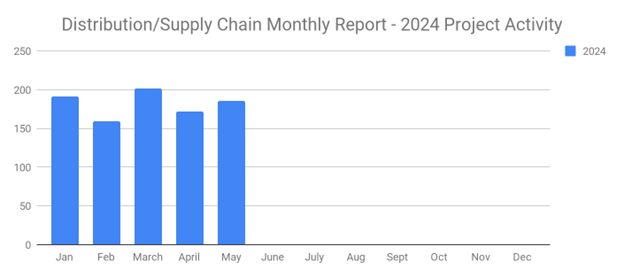

Sales Leads Inc. reports a significant increase in new distribution and supply chain projects for May 2024, with 186 new projects identified, up from 110 in April. This includes new constructions, expansions, and significant equipment upgrades. The largest project is an $800 million investment by Kikkoman Foods in Jefferson, WI.

Synopsis

Sales Leads Inc. announced the May 2024 results for the Distribution and Supply Chain industry, highlighting a substantial increase to 186 new planned projects. These include 161 industrial warehouses and 26 distribution/fulfillment centers. Significant investments, such as Kikkoman Foods' $800 million project in Wisconsin, mark the sector's growth. The top states for new projects are Texas, California, and Michigan.

Industrial SalesLeads announced today the May 2024 results for the new planned capital project spending report for the Distribution and Supply Chain industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction and significant equipment modernization projects. Research confirms 186 new projects in the Distribution and Supply Chain sector as compared to 110 in April 2024.

The following are selected highlights on new Distribution Center and Warehouse construction news.

Distribution and Supply Chain - By Project Type

Distribution/Fulfillment Centers - 26 New Projects

Industrial Warehouse - 161 New Projects

Distribution and Supply Chain- By Project Scope/Activity

New Construction - 87 New Projects

Expansion - 40 New Projects

Renovations/Equipment Upgrades - 65 New Projects

Closing - 12 New Projects

Distribution and Supply Chain - By Project Location (Top 5 States)

Texas - 18

California - 16

Michigan - 11

Ohio - 11

Florida - 9

Largest Planned Project

During the month of May, our research team identified 8 new Distribution and Supply Chain facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Kikkoman Foods, who is planning to invest $800 million for the construction of a processing, warehouse, and office facility in JEFFERSON, WI. The project includes the expansion and equipment upgrades of their existing plant in WALWORTH, WI. They are currently seeking approval for the project.

Top 10 Tracked Distribution and Supply Chain Project Opportunities

Georgia:

Hygiene products mfr. is planning to invest $418 million for the expansion and equipment upgrades on their manufacturing, warehouse, and office facility in MACON, GA. They are currently seeking approval for the project.

Tennessee:

Industrial paint and coating mfr. is planning to invest $225 million for the construction of a 250,000 sf processing and warehouse facility in KNOXVILLE, TN. They are currently seeking approval for the project. Construction is expected to start in late Summer 2024, with completion slated for 2026.

Alberta:

Cold chain logistics service provider is planning to invest $222 million for the construction of a 323,000 sf cold-storage warehouse in COALDALE, AB. They have recently received approval for the project.

Georgia:

Apparel company is planning to invest $130 million for the construction of a distribution center in LYONS, GA. They are currently seeking approval for the project. They will relocate their operations upon completion.

Texas:

Grocery chain is planning for the construction of a distribution campus in HEMPSTEAD, TX. They are currently seeking approval for the project. Construction will occur in multiple phases and is expected to start in late 2024.

California:

Military agency is planning to invest $98 million for the renovation of their office, medical, warehouse, and storage facility in SAN DIEGO, CA. They have recently received approval for the project.

Missouri:

Industrial gas supplier is planning to invest $70 million for the construction of processing and warehouse facility in MARYLAND HEIGHTS, MO. They are currently seeking approval for the project. Completion is slated for late 2025.

South Dakota:

Military agency is planning to invest $63 million for the construction of a 39,000 sf fuel system maintenance dock and warehouse facility at Ellsworth Air Force Base in RAPID CITY, SD. They have recently received approval for the project. Completion is slated for Fall 2026.

Michigan:

Municipality is planning to invest $62 million for the construction of a 144,000 sf warehouse facility at 1500 NW Scribner Ave. in GRAND RAPIDS, MI. They are currently seeking approval for the project.

Texas:

Commercial refrigeration equipment mfr. is planning to invest $55 million for the construction of a 470,000 sf manufacturing and warehouse campus in KILGORE, TX. They have recently received approval for the project. They will relocate their operations upon completion. The site allows for an additional 530,000 sf.

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team. Visit us at salesleadsinc.com.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Misc. Industrial Buildings

- Waste Water Treatment

- Data Centers

Analysis

The May 2024 report reveals robust growth in the distribution and supply chain sector, with a 69% increase in new projects compared to April. The focus on new constructions and expansions indicates strong demand for logistics and warehousing infrastructure. Key investments, particularly in states like Texas and California, underline the strategic importance of these regions in supply chain networks. The large-scale project by Kikkoman Foods exemplifies the sector's emphasis on modernization and capacity expansion.

FAQ

Q: What is the significance of the May 2024 report? A: The report highlights a substantial increase in new distribution and supply chain projects, reflecting strong sector growth and significant capital investments.

Q: Which project had the highest investment in May 2024? A: The largest investment is by Kikkoman Foods, planning an $800 million processing, warehouse, and office facility in Jefferson, WI.

Q: How does May 2024 compare to previous months in terms of new projects? A: May 2024 saw 186 new projects, a significant increase from 110 in April, indicating robust growth in the distribution and supply chain sector.

Q: What types of projects are included in the report? A: The report includes new constructions, expansions, renovations, equipment upgrades, and plant closings in the distribution and supply chain sector.

Q: Which states had the most new projects in May 2024? A: Texas led with 18 new projects, followed by California with 16, and Michigan and Ohio each with 11.

Glossary of Terms

Distribution and Supply Chain: The network involved in the production, handling, and distribution of goods from manufacturers to consumers.

Capital Project: A long-term, capital-intensive investment project aimed at building, adding, or improving a facility.

Distribution/Fulfillment Center: A facility where products are received, processed, and shipped to customers.

Industrial Warehouse: A building used for storing goods and materials.

Expansion: Enlarging a facility to increase its capacity or capabilities.

Renovation: Improving or modernizing a facility or equipment.

Equipment Upgrades: Enhancements or replacements of machinery or technology to improve efficiency or performance.

Plant Closings: The shutdown of an industrial facility, leading to the cessation of operations at that location.

Outsourced Prospecting Services: Services provided by an external company to identify and qualify potential sales leads for a business.

Industrial Market Intelligence (IMI): Insights and data on companies planning significant capital investments in industrial facilities.

What to learn more? Get in Touch