TL;DR

Sales Leads Inc. reported a 15% increase in planned industrial construction projects for May 2024, totaling 403 new projects. This includes significant investments across manufacturing, processing, distribution, and energy sectors. The largest project is Honda Canada Inc.'s $15 billion EV battery manufacturing complex in Alliston, ON.

Synopsis

Sales Leads Inc. announced that planned industrial construction projects increased by 15% in May 2024, with 403 new projects identified. These projects span various types, including manufacturing, processing, distribution, and energy. The report highlights significant investments, with the largest being Honda Canada Inc.'s $15 billion EV battery manufacturing complex. The top 10 states for new projects include Texas, California, and New York.

Research by Industrial SalesLeads’ experienced industrial market research team, shows 403 new planned industrial projects tracked during the month of May. Planned industrial project activity increased 13% from the previous month.

The following are selected highlights on new industrial construction news and project opportunities throughout North America.

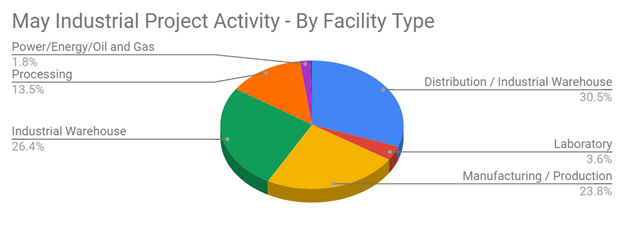

Planned Industrial Construction - By Project Type:

Manufacturing Facilities - 145 New Projects

Processing Facilities - 82 New Projects

Distribution and Industrial Warehouse - 186 New Projects

Power/Energy/Oil and Gas - 11 New Projects

Laboratory Facilities - 22 New Projects

Mine - 2 New Projects

Terminal - 0 New Projects

Pipeline - 0 New Projects

Planned Industrial Construction - By Scope/Activity

New Construction - 175 New Projects

Expansion - 105 New Projects

Renovations/Equipment Upgrades - 145 New Projects

Plant Closing - 27 New Projects

Planned Industrial Construction - By Location (Top 10 States)

Texas - 28

California - 26

New York - 24

Ohio - 24

Michigan - 20

Georgia - 18

North Carolina - 18

Florida - 16

Indiana - 14

Illinois - 12

Largest Planned Industrial Construction Project

During the month of May, our research team identified 44 new General Industrial facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Honda Canada Inc., who is planning to invest $15 billion for the construction of an EV battery manufacturing complex in ALLISTON, ON. They are currently seeking approval for the project. Completion is slated for 2028.

Top 10 Tracked Industrial Construction Projects

ILLINOIS:

EV mfr. is planning to invest $1.5 billion for the expansion and equipment upgrades on their manufacturing facility in NORMAL, IL. They are currently seeking approval for the project.

OHIO:

Energy company is planning to invest $1.5 billion for the expansion and equipment upgrades on their processing facilities in LIMA, OH, and OREGON, OH. They are currently seeking approval for the project.

INDIANA:

Automotive mfr. is planning to invest $1.4 billion for the expansion, renovation, and equipment upgrades on their manufacturing facility in PRINCETON, IN. Construction is expected to start in Fall 2024, with completion slated for late 2026.

WISCONSIN:

Specialty food processing company is planning to invest $800 million for the construction of a processing, warehouse, and office facility in JEFFERSON, WI. The project includes the expansion and equipment upgrades of their existing plant in WALWORTH, WI. They are currently seeking approval for the project.

QUEBEC:

Global technology company is planning to invest $730 million for the expansion and equipment upgrades on their manufacturing facility in BROMONT, QC. They are currently seeking approval for the project.

TEXAS:

Automotive mfr. is planning to invest $531 million for the expansion of their manufacturing facility at 1 Lone Star Pass in SAN ANTONIO, TX by 500,000 sf. They are currently seeking approval for the project.

MINNESOTA:

Semiconductor mfr. is planning to invest $525 million for the expansion and equipment upgrades on their manufacturing facility in BLOOMINGTON, MN. They are currently seeking approval for the project.

GEORGIA:

Hygiene products mfr. is planning to invest $418 million for the expansion and equipment upgrades on their manufacturing, warehouse, and office facility in MACON, GA. They are currently seeking approval for the project.

KANSAS:

Automotive mfr. is planning to invest $390 million for the renovation and equipment upgrades on their manufacturing facility at 3201 Fairfax Trafficway in KANSAS CITY, KS. They are currently seeking approval for the project.

NORTH CAROLINA:

Solar panel mfr. is planning to invest $300 million for the construction of a 1-million sf manufacturing facility in GREENVILLE, NC. They have recently received approval for the project.

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team. Visit us at salesleadsinc.com.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Misc. Industrial Buildings

- Waste Water Treatment

- Data Centers

Analysis

The May 2024 report shows a notable uptick in industrial construction projects, indicating robust activity in the sector. The diversity of project types, from manufacturing to energy, suggests a broad-based investment trend. The substantial increase in planned projects, particularly large-scale investments like Honda's, reflects confidence in the industrial sector's growth potential. The geographic distribution of projects highlights key states driving industrial expansion.

FAQ

Q: What is the significance of the May 2024 report? A: The report indicates a 15% increase in planned industrial construction projects, highlighting sector growth and significant capital investments.

Q: Which project had the highest investment in May 2024? A: The largest investment is by Honda Canada Inc., planning a $15 billion EV battery manufacturing complex in Alliston, ON.

Q: How does May 2024 compare to previous months in terms of new projects? A: May 2024 saw a 15% increase in new projects compared to the previous month, totaling 403 new projects.

Q: What types of projects are included in the report? A: The report includes new constructions, expansions, renovations, equipment upgrades, and plant closings across various industrial sectors.

Q: Which states had the most new projects in May 2024? A: Texas had 28 new projects, followed by California with 26, and New York and Ohio each with 24.

Glossary of Terms

Industrial Construction: The construction of industrial facilities, including manufacturing plants, warehouses, and energy infrastructure.

Capital Project: A long-term, capital-intensive investment project aimed at building, adding, or improving a facility.

EV Battery Manufacturing Complex: A facility dedicated to producing batteries for electric vehicles.

Expansion: Enlarging a facility to increase its capacity or capabilities.

Renovation: Improving or modernizing a facility or equipment.

Equipment Upgrades: Enhancements or replacements of machinery or technology to improve efficiency or performance.

Plant Closings: The shutdown of an industrial facility, leading to the cessation of operations at that location.

Outsourced Prospecting Services: Services provided by an external company to identify and qualify potential sales leads for a business.

Industrial Market Intelligence (IMI): Insights and data on companies planning significant capital investments in industrial facilities.

What to learn more? Get in Touch

Latest Posts

-

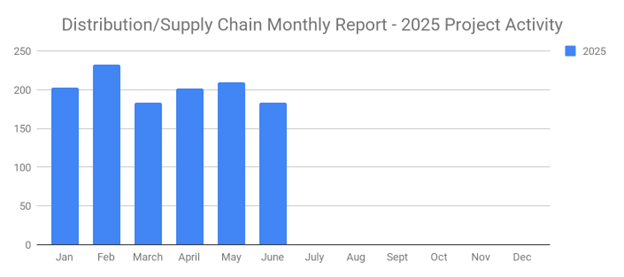

June's New Distribution and Supply Chain Planned Projects Return to March’s 183 Confirmed Figure

-

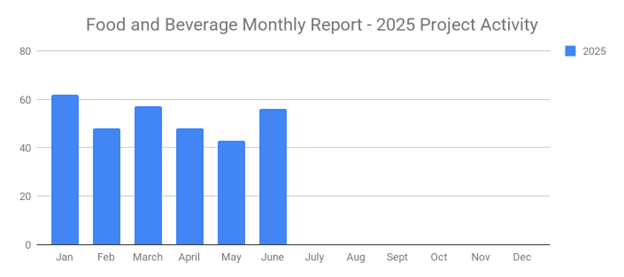

Food and Beverage Rebounds with 56 New Planned Projects Igniting Growth After Decline

-

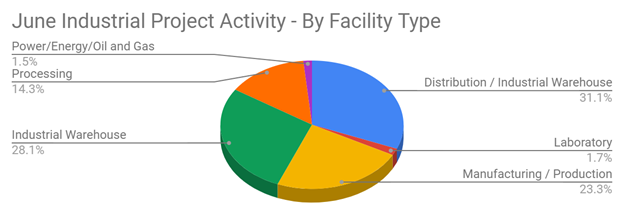

June 2025’s New Industrial Construction Projects Grew 7% Month-Over-Month

-

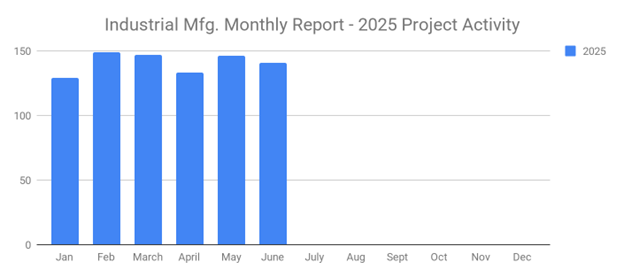

Q2 Industrial Manufacturing Soars 31% for Planned Projects Over $100M; June Planned Industrial Projects Hit 141