Understanding the difference between a short vs long sales cycle is crucial for B2B businesses trying to forecast revenue, allocate sales time, and prioritize the right accounts. A short sales cycle tends to happen when the buyer has urgency, low perceived risk, and a straightforward decision path. A long sales cycle is common when multiple stakeholders are involved, budgets require approval, and the buyer needs proof that the solution reduces risk or improves outcomes.

Below we break down how short and long sales cycles work, the tradeoffs of each, and practical ways to improve your win rate and time-to-close.

Q: What is a sales cycle?

A sales cycle is the series of steps from first contact to closed deal, including qualification, discovery, proposal, negotiation, and close.

Sales cycle: The end-to-end process from lead to closed deal.

Technical buyer: The person validating requirements, specs, or feasibility.

The Short Sales Cycle

A short sales cycle is defined by a quick and efficient process that results in a sale in a relatively short amount of time. This type of cycle is often tied to immediate needs, standard products, or familiar vendors.

Common short-cycle scenarios

-

Aftermarket parts needed to prevent downtime

-

Consumables and standard replenishment purchases

-

Low-risk services with clear scope and pricing

-

Repeat buys where vendor approval already exists

Advantages of a short sales cycle

-

Faster revenue generation

-

Lower cost of customer acquisition

-

Higher customer satisfaction when urgency is met

-

Ability to adapt quickly to market changes

Disadvantages of a short sales cycle

-

Limited opportunities for upselling

-

Lower loyalty (buyers can be price-driven)

-

Higher competition from similar providers

-

Less time to build strong relationships

How to improve short-cycle performance

-

Respond fast and remove friction (quote, availability, lead times)

-

Qualify in minutes, not days (need, timeline, spec, budget, authority)

-

Make the next step obvious (order link, call booking, clear follow-up)

Q: What causes a short sales cycle?

Lower perceived risk, urgency, fewer stakeholders, clear pricing, and a straightforward buying path.

Qualification: Determining whether a prospect is a fit and ready to buy.

Procurement: The function responsible for vendor approval, terms, and purchasing rules.

The Long Sales Cycle

A long sales cycle involves a more complex process that can take weeks, months, or longer. It’s common when the purchase is high value, high risk, or requires multiple stakeholders.

Common long-cycle scenarios

-

Capital equipment purchases

-

Facility expansions, new lines, plant modernization

-

Enterprise services/contracts and multi-site rollouts

-

Projects requiring safety, compliance, or procurement review

Advantages of a long sales cycle

-

Stronger stakeholder relationships

-

More opportunity for upsell and cross-sell

-

Higher loyalty and repeat business

-

Ability to demonstrate ROI and differentiation

Disadvantages of a long sales cycle

-

Higher cost of sales

-

Longer time to revenue

-

Higher risk of “deal drift” or churn

-

Harder forecasting without strict stage criteria

How to improve long-cycle performance

-

Map stakeholders early (economic buyer, technical buyer, procurement, ops)

-

Build a “proof package” (ROI, risk reduction, timeline, case studies)

-

Create momentum checkpoints (next meeting, next deliverable, next date)

-

Use stage gates so “maybe” doesn’t clog the pipeline

Q: What causes a long sales cycle?

Higher deal size, more stakeholders, procurement/compliance steps, technical evaluation, and a need for ROI justification.

Stakeholders: People involved in approving or influencing a purchase.

Deal drift: When a deal loses momentum and stalls without a clear next step.

When to Use Each Type of Sales Cycle

Choosing between a short or long sales cycle depends on your product/service, target market, and business goals.

A short sales cycle is usually best when:

-

Risk is low and the buyer can decide quickly

-

The product is standardized and easy to compare

-

The buyer has urgency (downtime, replacement, immediate need)

A long sales cycle is usually best when:

-

Multiple stakeholders must approve the purchase

-

The buyer needs proof (ROI, compliance, risk reduction)

-

The purchase is strategic, high-ticket, or operationally disruptive

The goal isn’t to force every deal into a short cycle. The goal is to match your selling motion to the buyer’s reality and keep deals moving with the right information at the right time.

Q: Can you shorten a long sales cycle without discounting?

Yes. Improve lead quality, tighten qualification, map stakeholders early, create proof assets (ROI/case studies), and set milestone-based next steps.

Economic buyer: The person who controls budget approval.

Time-to-close: The time it takes to move from first contact to signed agreement.

Key Takeaways

-

Short sales cycles win on speed, clarity, and low friction.

-

Long sales cycles win on trust, proof, stakeholder alignment, and momentum.

-

Pipeline quality is often the real lever: better-fit accounts shorten both cycles.

-

Qualification gates prevent “nice conversations” from hijacking your forecast.

Q: How do you forecast long-cycle deals more accurately?

Use stage criteria tied to buyer actions (not seller activity), track stakeholder alignment, and require next-step commitments.

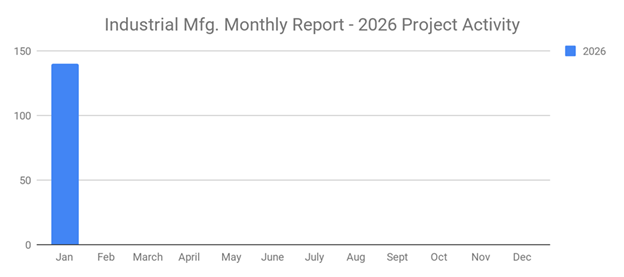

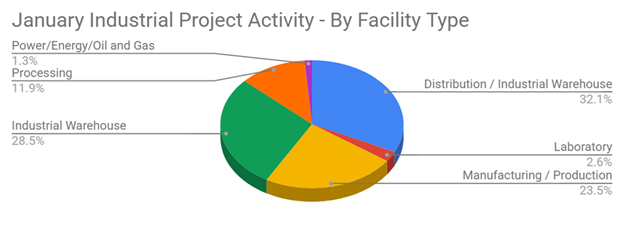

How Industrial SalesLeads Helps You Sell Smarter

Industrial SalesLeads helps B2B teams identify companies with active initiatives, expansion plans, and project activity so you can prioritize the accounts most likely to buy. When you target the right companies at the right time, you reduce wasted outreach, improve conversion rates, and accelerate time-to-close, whether your sales cycle is naturally short or long.

Want help reaching better-fit prospects and keeping your pipeline moving? Explore our Prospecting Services.

What to learn more? Get in Touch

Latest Posts

-

How Strategic B2B Marketing Supports Industrial Sales Success

-

Moving Beyond Volume: 3 Big Strategies for Developing Industrial Leads

-

January 2026 Surges with a 22% Increase in New Industrial Projects Erasing December’s Decline of 20%

-

Planned Industrial Construction Projects Start January 2026 Strong with an Increase of 3% from the Previous Month