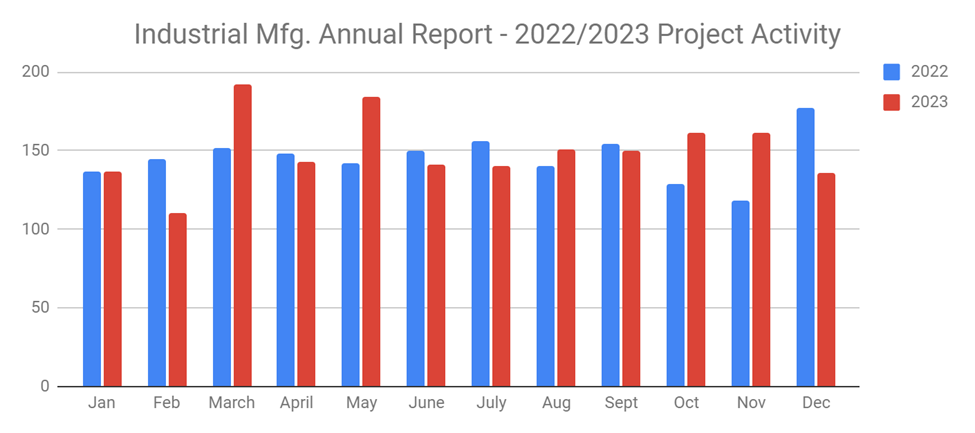

SalesLeads announced today the CY 2023 results for the new planned capital project spending report for the Industrial Manufacturing industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction and significant equipment modernization projects. Research confirms 1799 new projects in the Industrial Manufacturing sector identified in 2023.

Planned industrial project activity within the sector increased by 3% from the previous year.

The following are selected highlights on new Industrial Manufacturing industry construction news.

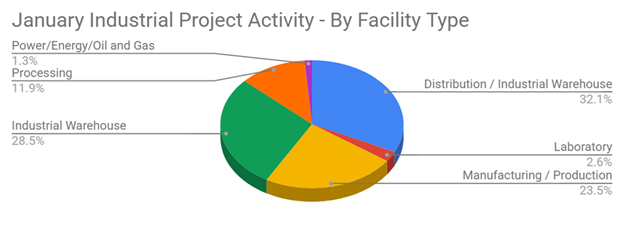

Industrial Manufacturing - By Project Type

Manufacturing/Production Facilities - 1608 New Projects

Distribution and Industrial Warehouse - 910 New Projects

Industrial Manufacturing - By Project Scope/Activity

New Construction - 568 New Projects

Expansion - 595 New Projects

Renovations/Equipment Upgrades - 685 New Projects

Plant Closing - 176 New Projects

Industrial Manufacturing - By Project Location (Top 10 States)

Indiana - 119

Michigan - 111

New York - 104

Texas - 104

Ohio - 100

California - 83

North Carolina - 81

Georgia - 78

Tennessee - 70

Wisconsin - 67

YOY Growth by State

Research shows that Nevada state had the highest increase of Industrial Manufacturing projects tracked, with 50% more projects identified than in 2022. Conversely, Missouri state showed the largest decline of projects tracked, with a 127% decline compared to 2022.

Most Active Month

Research shows that the most active month was March, where 192 new Industrial Manufacturing project opportunities were identified.

Largest Month to Month Increase in Projects Tracked

Research shows that there was a 43% increase in new projects tracked from February 2023 to March 2023. Conversely, Mar-Apr showed the largest month to month decline; with 192 new projects in March and 143 in April.

Opportunities - By Equipment Need

Manufacturing Equipment - 1302

Air Emissions Control Equipment - 1570

Compressed Air Systems - 1570

Control Systems and Instrumentation - 1463

Conveyors - 1463

Cranes and Hoists - 1329

Floor Coatings - 1018

Material Handling/Storage Equipment - 1616

Packaging Equipment - 1340

Equipment Relocation - 157

Largest Planned Project

During the year 2023, our research team identified 192 new Industrial Manufacturing facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Texas Instruments, who is investing $30 billion for the construction of a 4.7 million manufacturing, warehouse, and office campus at 501 W. Shepard Dr. in SHERMAN, TX. Construction is occurring in phases, with the completion of the first phase slated for early 2025.

Top 12 Largest Industrial Manufacturing Projects

JANUARY

Automotive mfr. is planning to invest $795 million for the renovation and equipment upgrades on their manufacturing facilities in FLINT, MI and BAY CITY, MI.

FEBRUARY

Semiconductor mfr. is planning to invest $11 billion for the construction of a manufacturing facility in LEHI, UT. Completion is slated for early 2026.

MARCH

Battery mfr. is planning to invest $5.5 billion for the construction of a manufacturing facility in QUEEN CREEK, AZ. Completion is slated for 2025.

APRIL:

Technology company is planning to invest $1.5 billion for an expansion of a recently acquired manufacturing facility at 7501 Foothills Blvd. in ROSEVILLE, CA. Completion is slated for 2026.

MAY:

Semiconductor equipment mfr. is planning to invest $4 billion for the construction of a manufacturing, laboratory, and office facility in SUNNYVALE, CA. Completion is slated for 2026.

JUNE:

Automotive mfr. is planning to invest $3 billion for the construction of an EV battery manufacturing facility in NEW CARLISLE, IN. Construction is expected to start in 2025, with completion slated for 2026.

JULY:

Plastic resin and petrochemical supplier is planning to invest $12 billion for the construction of a processing facility in ST. JAMES, LA. Construction is expected to start in Summer 2024.

AUGUST:

Battery technology company is planning to invest $2 billion for the construction of an EV battery manufacturing facility in MANTENO, IL.

SEPTEMBER:

Diesel engine mfr. is considering investing $3 billion for the construction of a battery manufacturing facility and currently seeking a site in INDIANA.

OCTOBER:

Battery mfr. is planning to invest $5 billion for the construction of a manufacturing facility in MCMASTERVILLE, QC. They have recently received approval for the project. Completion is slated for late 2026.

NOVEMBER:

Global electronics mfr. is planning to invest $8 billion for the construction of an additional 2.7 million manufacturing facility in TAYLOR, TX. They are currently seeking approval for the project. Construction is expected to start in late 2024.

DECEMBER:

Battery mfr. is planning to invest $5 billion for the construction of a manufacturing facility in ST. THOMAS, ON. They have recently received approval for the project. Completion is slated for 2027.

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team. Visit us at salesleadsinc.com.

Each month, our team provides hundreds ofindustrial reportswithin a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

How Strategic B2B Marketing Supports Industrial Sales Success

-

Moving Beyond Volume: 3 Big Strategies for Developing Industrial Leads

-

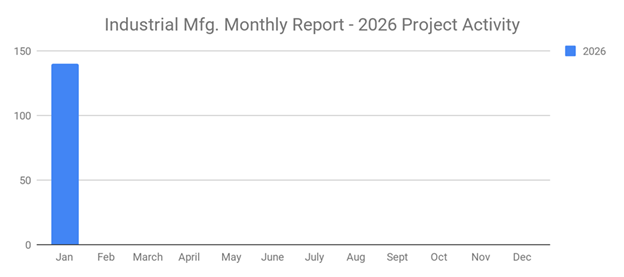

January 2026 Surges with a 22% Increase in New Industrial Projects Erasing December’s Decline of 20%

-

Planned Industrial Construction Projects Start January 2026 Strong with an Increase of 3% from the Previous Month