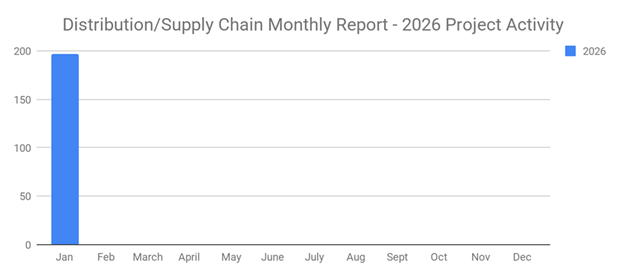

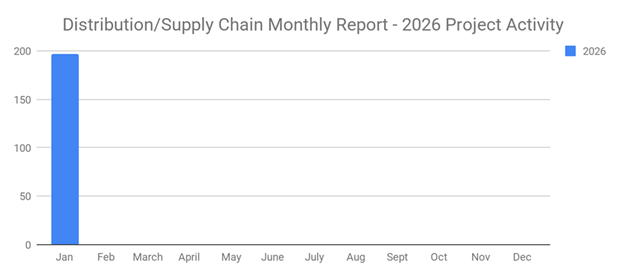

Industrial SalesLeads announced today the Distribution and Supply Chain planned capital projects spending report for January 2026. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction and significant equipment modernization projects. Research confirms 197 new projects in January, a 4% decrease from December in the Distribution and Supply Chain sector.

The following are selected highlights on new Distribution Center and Warehouse construction news.

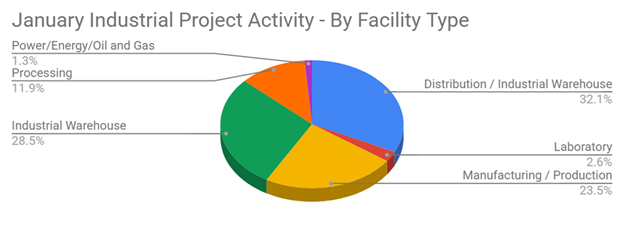

Distribution and Supply Chain - By Project Type

Distribution/Fulfillment Centers - 23 New Projects

Industrial Warehouse - 175 New Projects

Distribution and Supply Chain- By Project Scope/Activity

New Construction - 81 New Projects

Expansion - 35 New Projects

Renovations/Equipment Upgrades - 84 New Projects

Closing - 7 New Projects

Distribution and Supply Chain - By Project Location (Top 5 States)

Florida - 14

Georgia - 13

California - 12

Texas - 12

New York - 11

Largest Planned Project

During the month of January, our research team identified 7 new Distribution and Supply Chain facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Amazon, who is planning to invest $500 million for the renovation and equipment upgrades on a 1.1 million sf distribution center at 7055 Campbellton Rd. in ATLANTA, GA. They are currently seeking approval for the project.

Top 10 Tracked Distribution and Supply Chain Project Opportunities

Michigan:

Coffee and beverage company is planning to invest $479 for the expansion of their processing and warehouse facility in NORTON SHORES, MI. They are currently seeking approval for the project.

Louisiana:

Global retail chain is planning to invest $330 million for the renovation and equipment upgrades on their 1.3 million sf distribution center in OPELOUSAS, LA. They are currently seeking approval for the project.

Louisiana:

Production company is planning to invest $124 million for the renovation and equipment upgrades on three warehouse and studio facilities in SHREVEPORT, LA. Construction will occur in phases and is expected to start in Spring 2026, with completion slated for early 2027.

Alabama:

HVAC equipment mfr. is planning to invest $119 million for the renovation and equipment upgrades on a 460,000 sf manufacturing and warehouse facility at 7700 Gunters Way in HUNTSVILLE, AL. They are currently seeking approval for the project.

Tennessee:

Global shipping company is planning for the construction of a 1.6 million sf distribution center at 2753 Sprankel Ave. in MEMPHIS, TN. They are currently seeking approval for the project.

Florida:

Waste management service provider is planning to invest $88 million for the construction of a 109,000 sf warehouse and recycling facility at 1400 N. 35th St. in TAMPA, FL. They are currently seeking approval for the project. Construction is expected to start in Spring 2026, with completion slated for late 2027.

Florida:

Cold storage service provider is planning to invest $44 million for the construction of a 151,000 sf warehouse facility at 12723 S. US Hwy. 41 in GIBSONTON, FL. They are currently seeking approval for the project.

South Carolina:

Municipality is planning to invest $43 million for the construction of a 70,000 sf warehouse facility on Glenn McConnell Pkwy. in CHARLESTON, SC. They are currently seeking approval for the project.

North Carolina:

HVAC contractor is planning to invest $40 million for the renovation and equipment upgrades in a 100,000 sf manufacturing facility and a 170,000 sf office and warehouse facility in GREENSBORO, NC. They are currently seeking approval for the project and will consolidate their operations upon completion.

Oklahoma:

Beverage distributor is planning to invest $37 million for the construction of a 260,000 sf warehouse and office facility at 13412 E Admiral Place S in TULSA, OK. They are currently seeking approval for the project.

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team. Visit us at salesleadsinc.com.

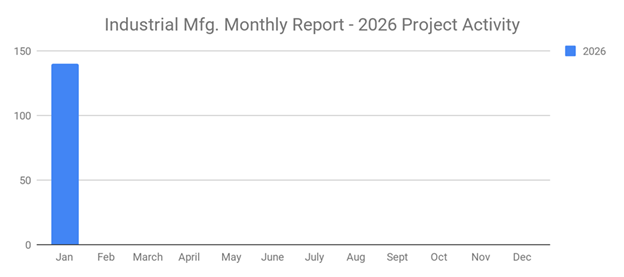

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

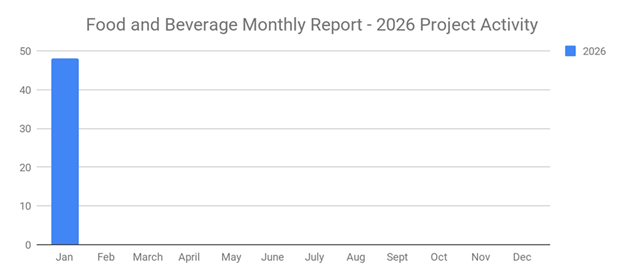

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Misc. Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

January 2026 Surges with a 22% Increase in New Industrial Projects Erasing December’s Decline of 20%

-

Planned Industrial Construction Projects Start January 2026 Strong with an Increase of 3% from the Previous Month

-

New Food and Beverage Planned Projects Return to May 2025 Levels

-

197 New Distribution and Supply Chain Planned Industrial Projects Declines by 4% to Start January 2026