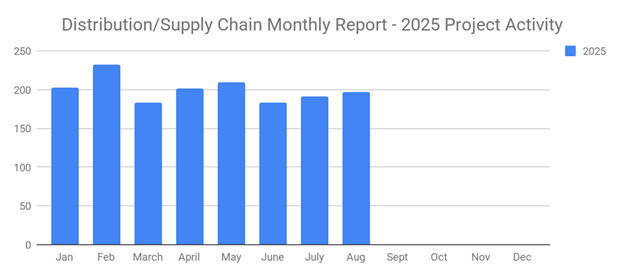

Industrial SalesLeads announced today the August 2025 results for its planned capital project spending MiR report covering the Distribution and Supply Chain sector. The Firm tracks North American industrial project activity including facility expansions, new construction, and major equipment modernizations.

In August, research identified 197 new projects, compared to 191 in July, representing a 3.1% increase. While overall project volume moved up modestly, the more meaningful signal was where investment is concentrating: distribution and fulfillment centers jumped to 30 new projects (from 10 in July), a 200% increase.

For sales and marketing teams supporting warehouse construction, automation, material handling equipment (MHE), racking, controls, WMS/WES, systems integration, and facility services, fulfillment center growth is often the “early thunder” before the larger purchasing storm.

The following are selected highlights on new Distribution Center and Warehouse construction news.

Q: What does the 3.1% increase mean?

A: It’s the month-over-month change in new projects identified in the sector: 197 in August vs 191 in July.MiR Report: A monthly industry report summarizing planned capital project activity identified by Industrial SalesLeads research.

Distribution and Supply Chain Projects: August 2025 Breakdown

By Project Type

-

Distribution/Fulfillment Centers: 30 new projects

-

Industrial Warehouse: 163 new projects

By Project Scope/Activity

-

New Construction: 78 new projects

-

Expansion: 36 new projects

-

Renovations/Equipment Upgrades: 77 new projects

-

Closing: 4 new projects

By Project Location (Top 5 States)

-

Texas: 19

-

Georgia: 14

-

California: 13

-

New York: 12

-

Michigan: 11

Q: Why highlight fulfillment centers separately?

A: Fullfillment projects often drive demand for automation, MHE, racking, WMS/WES, construction services, and systems integration. August showed 30 new distribution/fulfillment centers vs 10 in July.

IMI (Industrial Market Intelligence): SalesLeads’ intelligence program tracking planned projects like new construction, expansions, relocations, modernizations, and closings.

Largest Planned Project Identified in August 2025

During the month of August, our research team identified six new Distribution and Supply Chain facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Red Bull North America, which is planning to invest $740 million for the construction of a 2 million sf processing, distribution, and office facility at 2321 Concord Pkwy S in Concord, NC. The project is currently seeking approval.

Q: How can sales teams use this report immediately?

A: Prioritize outreach by project type, scope (new construction vs upgrades), and state concentration, then target high-value projects and accounts early in the approval cycle.

Distribution/Fulfillment Center: Facilities designed to receive, store, pick, pack, and ship goods, often tied to e-commerce and rapid replenishment.

Top 10 Tracked Distribution and Supply Chain Project Opportunities

Vermont

A technical school is planning to invest $149 million for the construction of a 167,000 sf institutional, warehouse, and training center in Graniteville, VT. The project is currently seeking approval and will relocate operations upon completion in 2028.

Arkansas

A PVC electrical component manufacturer is planning to invest $120 million for renovation and equipment upgrades at a recently acquired 351,000 sf manufacturing and warehouse facility at 630 Highway 27 Bypass in Nashville, AR. Completion is slated for late 2025.

Michigan

A data center developer is planning the construction of a 2 million sf data center, office, and warehouse campus in Saline Township, MI. The project is currently seeking approval.

California

A global retail chain is planning the construction of a 949,000 sf distribution and office facility on Elkhorn Blvd. in Sacramento, CA. The project is currently seeking approval.

Nevada

A footwear manufacturer is planning to invest $80 million for the expansion, renovation, and equipment upgrades on its distribution center at 11515 N Donald Lee Adams Pkwy. in North Las Vegas, NV. The project is currently seeking approval and will consolidate operations upon completion.

California

A municipality is planning to invest $70 million for the construction of a 43,000 sf warehouse, storage, and office facility on Kenilworth Dr. in Petaluma, CA. The project is currently seeking approval and will consolidate operations upon completion.

Oklahoma

An aviation service provider is planning to invest $65 million for the construction of a 130,000 sf warehouse and maintenance hangar in Burns Flat, OK. The project has recently received approval.

New York

A startup medicinal marijuana provider is planning to invest $40 million for the construction of a 58,000 sf growing, processing, and distribution facility at 11580 Walden Ave. in Alden, NY. The project is currently seeking approval, with construction expected to start in late 2025.

Tennessee

A specialty glass manufacturer is planning to invest $31 million for the expansion of its manufacturing and warehouse facility in Cumberland City, TN. The project is currently seeking approval.

Massachusetts

A waste disposal service provider is planning to invest $30 million for a 65,000 sf expansion of its warehouse and transfer station at 100 Duchaine Blvd. in New Bedford, MA. The project is currently seeking approval.

Q: What does “seeking approval” tell us?

A: The project is active but not fully permitted or finalized, so timing can shift. It’s still prime time for early engagement and relationship-building.

Renovations/Equipment Upgrades: Modernization work that can include automation, conveyors, robotics, racking, cold storage, controls, and process improvements.

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads, based in Jacksonville, FL, has delivered industrial capital project intelligence and outsourced prospecting services for sales and marketing teams seeking a predictable and scalable pipeline. Our Industrial Market Intelligence (IMI) identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization, and plant closings. Our Outsourced Prospecting Services extend your sales team by driving growth with qualified meetings and appointments. Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Misc. Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

How Strategic B2B Marketing Supports Industrial Sales Success

-

Moving Beyond Volume: 3 Big Strategies for Developing Industrial Leads

-

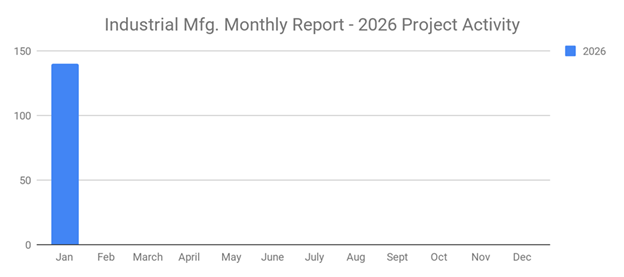

January 2026 Surges with a 22% Increase in New Industrial Projects Erasing December’s Decline of 20%

-

Planned Industrial Construction Projects Start January 2026 Strong with an Increase of 3% from the Previous Month