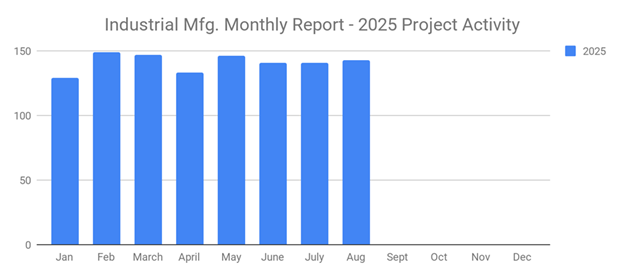

Industrial SalesLeads, Inc. released its August 2025 MiR report covering planned capital spending in the Industrial Manufacturing sector. The firm tracks North American industrial capital project activity across facility expansions, new plant construction, and significant renovations and equipment modernization. August recorded 143 new Industrial Manufacturing projects, a slight increase from 141 projects in both June and July. In parallel, Distribution and Industrial Warehouse activity rose to 72 projects, up from 65 projects in July (+10.8%), reflecting continued investment in production, logistics capacity, and site-level modernization.

Q: Why does a “steady plus” month matter in Industrial Manufacturing?

A: Because stability in project volume often signals that capital planning is staying active even as timing shifts between new builds, expansions, and upgrades. For sales and marketing teams, it means a consistent stream of near-term opportunities tied to approvals, equipment needs, and contractor activity.

MiR Report: Monthly summary of planned industrial construction and capital project activity tracked across North America.

The following are selected highlights on new Industrial Manufacturing industry construction news:

Industrial Manufacturing Projects by Type

-

Manufacturing/Production Facilities: 124 new projects

-

Distribution and Industrial Warehouse: 72 new projects

Industrial Manufacturing Projects by Scope and Activity

-

New Construction: 42 new projects

-

Expansion: 34 new projects

-

Renovations and Equipment Upgrades: 67 new projects

-

Plant Closings: 15 new projects

Q: Which project scope is usually most actionable for faster sales cycles?

A: Renovations and equipment upgrades. These projects are tied to operational needs (capacity, uptime, automation, compliance), often have shorter approval windows, and can move faster than ground-up construction.

Industrial Manufacturing Projects by Location (Top States)

-

Michigan: 10

-

Indiana: 9

-

Florida: 7

-

Tennessee: 7

-

Alabama: 6

-

California: 6

-

Georgia: 6

-

New York: 6

-

Ohio: 6

-

Texas: 6

-

Massachusetts: 5

Largest Planned Project

During August, our research team identified 16 new Industrial Manufacturing facility construction projects with an estimated value of $100 million+.

The largest project is owned by Hyundai Motor Group, which is planning to invest $13 billion for the expansion of its manufacturing facility at 700 Hyundai Blvd. in Montgomery, Alabama. The project is currently seeking approval. Completion is slated for 2028.

Q: How should teams use this MiR report internally?

A: Treat it like a targeting map. Assign owners by geography and project type, tailor messaging to scope (new build vs expansion vs upgrades), and build follow-up cadence around approvals, permitting, and phase timing.

Renovations/Equipment Upgrades: Modernization work to improve output, efficiency, safety, compliance, uptime, or cost.

Expansion: Added square footage, added lines, capacity increases, or new operational areas at an existing site.

Plant Closings: A shutdown or consolidation event that can signal network changes and follow-on capacity needs elsewhere.

Top Tracked Industrial Manufacturing Project Opportunities

-

Kentucky: Global computer and technology product manufacturer planning to invest $3 billion for expansion, renovations, and equipment upgrades on a manufacturing facility in Harrodsburg, KY. Currently seeking approval.

-

Indiana: Steel company planning to invest $3 billion for renovation and equipment upgrades on its manufacturing facility in Gary, IN. Currently seeking approval.

-

Kentucky: Automotive manufacturer planning to invest $2 billion for renovation and equipment upgrades on its manufacturing facility in Louisville, KY. Completion slated for Spring 2027.

-

North Carolina: Electronic components manufacturer planning to invest $500 million for renovation and equipment upgrades on a 422,000 sq ft manufacturing facility at 2121 Heilig Rd., Granite Quarry, NC. Recently approved. Completion slated for mid-2026.

-

Illinois: Solar panel manufacturer considering investing $300 million for construction of a manufacturing and office facility in Waukegan, IL. Watch SalesLeads for updates.

-

Texas: Startup cloud-based electronics manufacturer planning to invest $229 million for construction of a manufacturing, laboratory, and office facility at 4400 Alliance Gateway Fwy., Fort Worth, TX. Multi-phase build with first phase completion slated for late 2027.

-

Arizona: Startup defense technology company planning to invest $200 million for renovation and equipment upgrades on a recently leased 270,000 sq ft manufacturing facility in Mesa, AZ. Completion slated for early 2026.

-

Illinois: Pharmaceutical company planning to invest $195 million for construction of a processing facility in North Chicago, IL. Construction expected to start Fall 2025, with completion slated for 2027.

-

Arkansas: PVC electrical component manufacturer planning to invest $120 million for renovation and equipment upgrades on a recently acquired 351,000 sq ft manufacturing and warehouse facility at 630 Highway 27 Bypass, Nashville, AR. Completion slated for late 2025.

-

Louisiana: Containerboard and corrugated box manufacturer planning to invest $119 million for renovation and equipment upgrades on its manufacturing facility in St. Francisville, LA. Recently approved. Completion slated for Summer 2027.

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads, based in Jacksonville, FL, has delivered industrial capital project intelligence and prospecting services for sales and marketing teams to help build a predictable and scalable pipeline. Industrial Market Intelligence (IMI) identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization, and plant closings. Prospecting Services extend sales teams with qualified meetings and appointments.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Misc. Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

How Strategic B2B Marketing Supports Industrial Sales Success

-

Moving Beyond Volume: 3 Big Strategies for Developing Industrial Leads

-

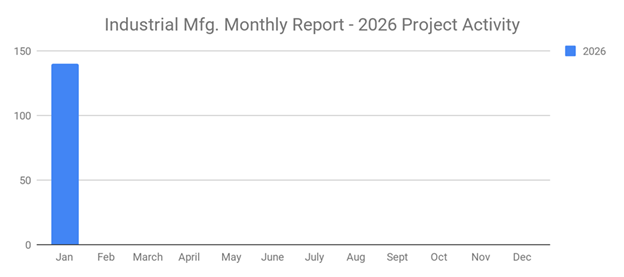

January 2026 Surges with a 22% Increase in New Industrial Projects Erasing December’s Decline of 20%

-

Planned Industrial Construction Projects Start January 2026 Strong with an Increase of 3% from the Previous Month