Industrial SalesLeads’ market research team tracked 413 newly planned industrial construction projects in January 2025, reflecting a modest 2% decline from December’s activity. While the volume dipped slightly, the data continues to highlight strong momentum across manufacturing, processing, and distribution sectors.

The following are selected highlights on new industrial construction news and project opportunities throughout North America.

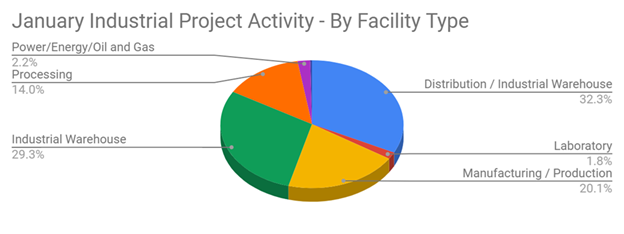

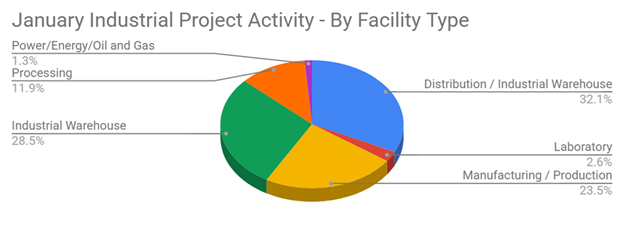

Planned Industrial Construction by Type

-

Manufacturing Facilities – 126

-

Processing Facilities – 88

-

Distribution & Industrial Warehouse – 203

-

Power/Energy/Oil & Gas – 14

-

Laboratory Facilities – 11

-

Mines – 2

-

Terminals – 0

-

Pipelines – 0

Planned Industrial Construction by Scope/Activity

-

New Construction – 190

-

Expansion – 77

-

Renovations & Equipment Upgrades – 155

-

Plant Closings – 23

Top States for Industrial Project Activity

-

New York – 31

-

Texas – 27

-

California – 25

-

North Carolina – 23

-

Ohio – 23

-

Florida – 20

-

Wisconsin – 20

-

Indiana – 18

-

Michigan – 18

-

Pennsylvania – 14

Largest Planned Industrial Project

The standout for January is Hyundai-Steel America, Inc., announcing plans to invest $7 billion in a New Orleans, LA manufacturing facility. Construction is expected to start in early 2026, with completion slated for 2029.

Top 10 Industrial Projects Tracked

Minnesota – Mining company investing $2.2B in a mine, processing, and manufacturing complex (completion 2026).

Arizona – Copper mining & processing facility, $2B investment in Tucson.

Illinois – Energy company planning $1B 468 MW wind farm in Livingston County.

New York – Semiconductor mfr., $575M new lab/manufacturing facility plus $186M in renovations in Malta.

South Carolina – Aggregate supplier, $450M in new processing facilities across multiple counties.

North Dakota – Potato processing facility in Grand Forks, $450M, completion by 2028.

Texas – Bakery mfr., $410M processing facility in Lancaster (phased through 2030).

Nova Scotia – Paper mill, $400M wind farm in Guysborough County.

North Carolina – Aerospace component mfr., $285M expansion in Asheville.

Iowa – Paper product mfr., $260M new 900,000 sf facility in Waterloo.

Planned Industrial Projects: Refers to upcoming construction, expansion, or renovation projects identified before ground is broken, giving sales & marketing teams a pipeline to target.

Q: What is driving industrial project activity in January 2025?

A: Manufacturing and distribution lead the way, accounting for over 75% of total projects.

Q: How does this compare to December 2024?

A: January saw a slight 2% decline, but investment in mega-projects ($100M+) remains strong.

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads (Jacksonville, FL) has delivered capital project intelligence and outsourced prospecting services for industrial sales and marketing teams. With Industrial Market Intelligence (IMI), the firm identifies timely insights on new construction, expansions, relocations, equipment modernization, and plant closings in industrial facilities across North America. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Misc. Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

How Strategic B2B Marketing Supports Industrial Sales Success

-

Moving Beyond Volume: 3 Big Strategies for Developing Industrial Leads

-

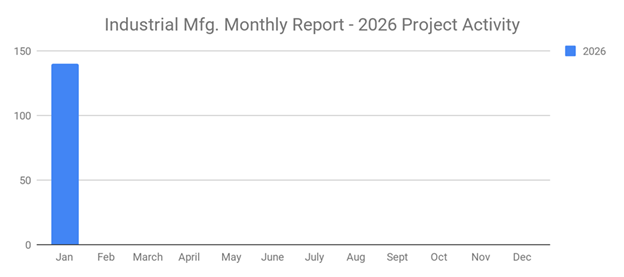

January 2026 Surges with a 22% Increase in New Industrial Projects Erasing December’s Decline of 20%

-

Planned Industrial Construction Projects Start January 2026 Strong with an Increase of 3% from the Previous Month