Research from Industrial SalesLeads’ experienced industrial market research team identified 394 new planned industrial projects across North America in June 2025, including a 7 percent month-over-month increase in new manufacturing facilities.

The following are selected highlights on new industrial construction news and project opportunities throughout North America.

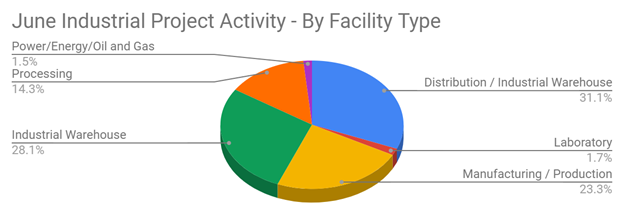

Planned Industrial Construction – By Project Type

- Manufacturing Facilities – 137 new projects

- Processing Facilities – 84 new projects

- Distribution and Industrial Warehouse – 183 new projects

- Power / Energy / Oil and Gas – 9 new projects

- Laboratory Facilities – 10 new projects

- Mine – 0 new projects

- Terminal – 0 new projects

- Pipeline – 0 new projects

Q: What counts as a “new” industrial construction project?

A: Projects included in this report have been publicly announced, budgeted, and validated by Industrial SalesLeads’ research team. They cover new facilities, major expansions, and significant upgrades that materially change capacity or capability—not routine maintenance.

Planned Industrial Construction – By Scope or Activity

- New Construction – 183 new projects

- Expansion – 83 new projects

- Renovations / Equipment Upgrades – 131 new projects

- Plant Closings – 22 new projects

Glossary: Month Over Month Growth – A comparison of activity from one month to the next. In this report, a 7 percent month-over-month increase refers to the rise in June 2025 manufacturing facility projects compared to May 2025.

Planned Industrial Construction – Top 10 States by Project Count

June’s new project activity continues to cluster around major manufacturing and logistics hubs:

- Texas – 28 projects

- California – 27 projects

- New York – 24 projects

- Indiana – 21 projects

- Ohio – 20 projects

- Florida – 18 projects

- Michigan – 18 projects

- Pennsylvania – 16 projects

- Georgia – 15 projects

- Tennessee – 14 projects

Glossary: General Industrial Facility – A broad category that includes manufacturing plants, processing facilities, logistics and warehouse assets, and supporting infrastructure such as labs and energy assets serving industrial operations.

Largest Planned Industrial Construction Project – June 2025

During the month of June, the research team identified 35 new General Industrial facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Micron Technology, which is planning to invest $150 billion for the construction of a new manufacturing complex in Clay, New York. Construction is expected to start in late 2025.

Q: What is considered a “mega-project” in this report?

A: Industrial SalesLeads typically classifies projects as “mega-projects” when their total value is $100 million or more in construction and equipment investment.

Top 10 Tracked Industrial Construction Projects – June 2025

Utah

A semiconductor manufacturer is planning to invest $15 billion for the expansion and equipment upgrades of their manufacturing facility in Lehi, UT. They are currently seeking approval for the project.

Georgia

A pharmaceutical company is considering investing $5 billion for the construction of a new processing facility and is currently seeking a site in Georgia. Watch Industrial SalesLeads for updates as the site selection progresses.

New Mexico

An energy company is considering investing $1 billion for the construction of a 150 MW geothermal power plant and is currently seeking a site in the northern New Mexico area. Watch Industrial SalesLeads for updates.

Florida

A gas turbine engine manufacturer is planning to invest $1 billion for the construction of a 1 million sq. ft. manufacturing facility in Crestview, FL. They are currently seeking approval for the project. Construction will occur in three phases, with completion of the first phase slated for late 2026.

Florida

A semiconductor manufacturer is planning to invest $470 million for the construction of a manufacturing and office facility in NeoCity, FL. They are currently seeking approval for the project.

Louisiana

An industrial gas manufacturer is planning to invest $400 million for the construction of a processing facility in Ascension Parish, LA. Construction is expected to start in 2026, with completion slated for 2029.

Maryland

A cold chain logistics service provider is planning to invest $275 million for the construction of a 400,000 sq. ft. cold-storage distribution facility at 45 West Oak Ridge Drive in Hagerstown, MD. They have recently received approval for the project.

South Carolina

A lumber company is planning to invest $225 million for the construction of a 375,000 sq. ft. manufacturing facility on Barker Mill Pond Rd. in Fairfax, SC. They are currently seeking approval for the project. Construction is expected to start in late 2025, with completion slated for early 2027.

Indiana

A renewable energy company is planning to invest $200 million for the construction of a 100 MW solar farm in Scott Township, IN. They are currently seeking approval for the project. Completion is slated for summer 2028.

Wisconsin

An industrial automation equipment manufacturer is planning to invest $180 million for the expansion of their manufacturing, laboratory, and office campus in Franklin, WI. They will consolidate their Wisconsin and Illinois operations upon completion in summer 2027.

Glossary: Industrial Market Intelligence – A curated data set of verified capital project opportunities, including contact details, project scope, timing, and facility information that sales and marketing teams use to prioritize outreach and build pipeline.

About Industrial SalesLeads

Since 1959, Industrial SalesLeads has been a leader in industrial capital project intelligence and prospecting services for sales and marketing teams. The company identifies timely insights on organizations planning significant capital investments such as new construction, expansion, relocation, equipment modernization, and plant closings in industrial facilities across North America.

Q: How can sales teams use the June 2025 report?

A: Sales teams use Industrial SalesLeads project data to target in-market accounts earlier in the buying cycle, prioritize territories by active capital spending, and book qualified meetings with decision-makers before formal bids or RFPs are issued.Industrial SalesLeads’ Industrial Market Intelligence (IMI) provides sales-ready details on companies planning significant capital investments, while Outsourced Prospecting Services act as an extension of your sales team to drive growth with qualified meetings and appointments. Visit us at salesleadsinc.com.

Each month, the team delivers hundreds of industrial reports across a wide range of sectors, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Misc. Industrial Buildings

- Waste Water Treatment

- Data Centers

What to learn more? Get in Touch

Latest Posts

-

How Strategic B2B Marketing Supports Industrial Sales Success

-

Moving Beyond Volume: 3 Big Strategies for Developing Industrial Leads

-

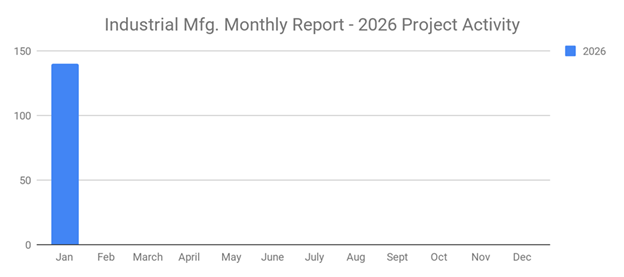

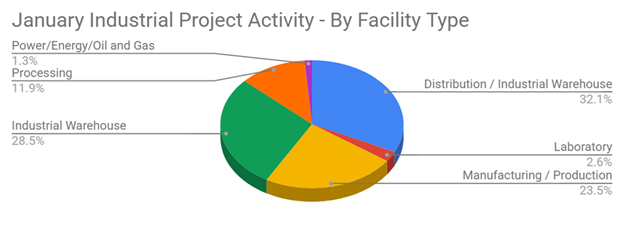

January 2026 Surges with a 22% Increase in New Industrial Projects Erasing December’s Decline of 20%

-

Planned Industrial Construction Projects Start January 2026 Strong with an Increase of 3% from the Previous Month